Bond Directory

Bond Directory

Explore & search from a diverse selection of government and corporate bonds in India on grip invest bond directory

Explore & search from a diverse selection of government and corporate bonds in India on grip invest bond directory

Explore & search from a diverse selection of government and corporate bonds in India on grip invest bond directory

Explore Bonds on Grip

List of Corporate Bonds in India

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

Load More

Grip Invest deals

Our Curated Bonds

BOND CATEGORIES

Explore Bonds by Categories

Explore Bonds by Categories

Why Invest via Grip Invest?

₹1,000

Minimum Investment

₹1,000

Minimum Investment

₹1,000

Minimum Investment

4 Lac+

Trusted Investors

4 Lac+

Trusted Investors

4 Lac+

Trusted Investors

Upto 14%

Fixed Returns

Upto 14%

Fixed Returns

Upto 14%

Fixed Returns

Start Investing Now

How to Invest in Corporate Bonds through Grip Invest?

1

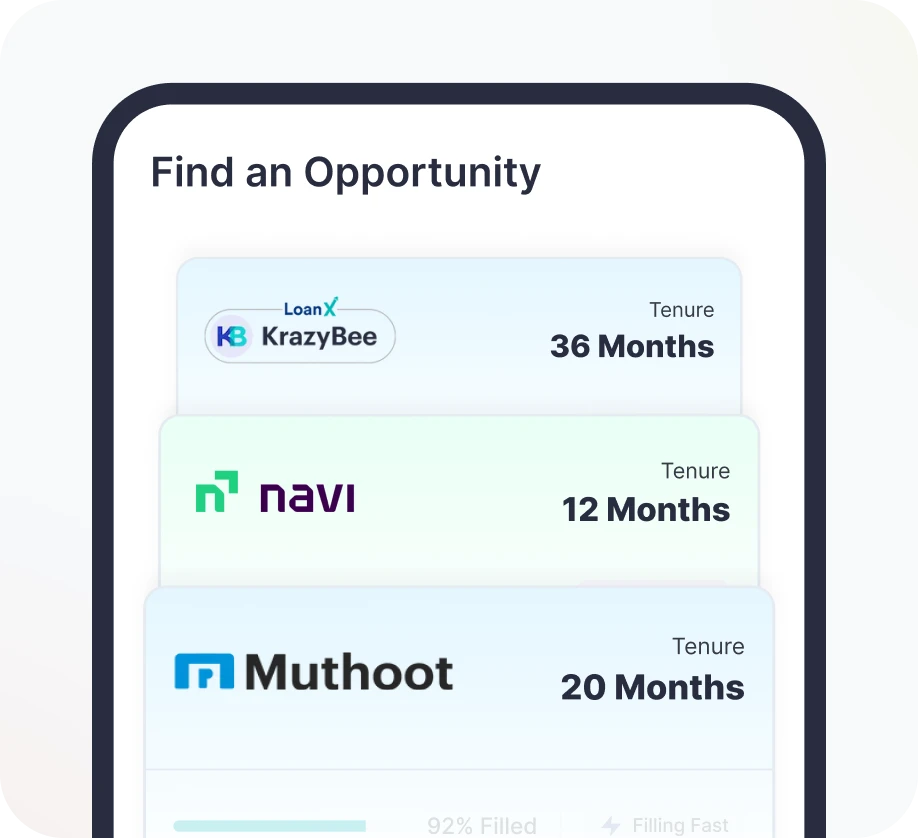

Discover Bonds Tailored to Your Needs

Browse a thoughtfully curated selection of top-rated corporate bonds

2

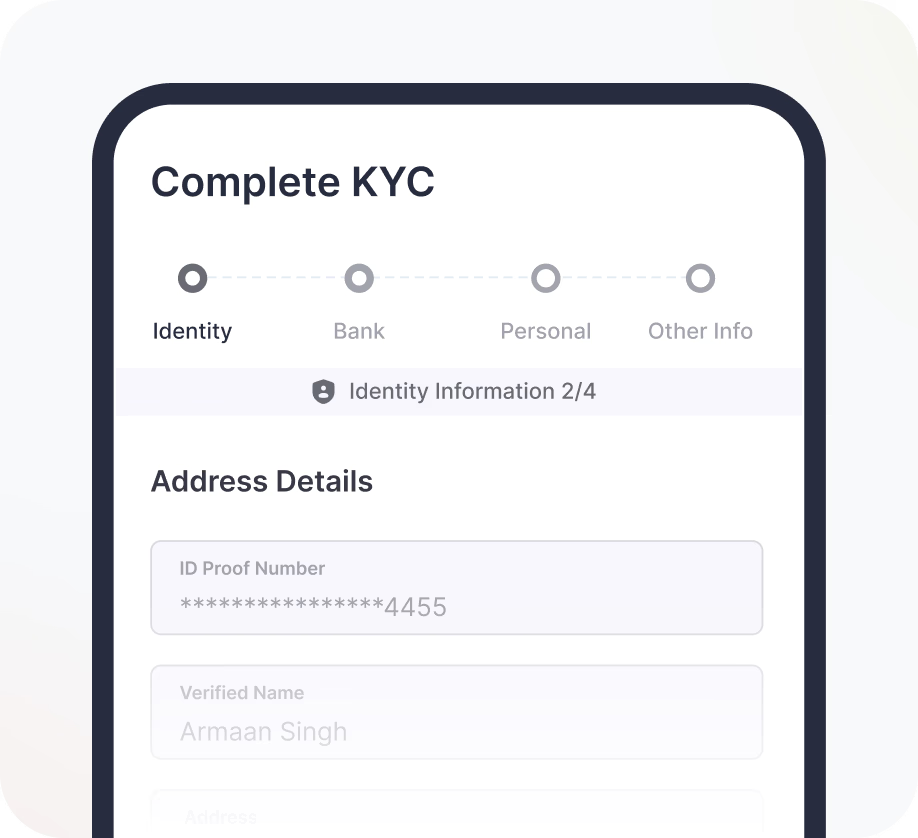

Complete KYC and Begin Your Journey

3

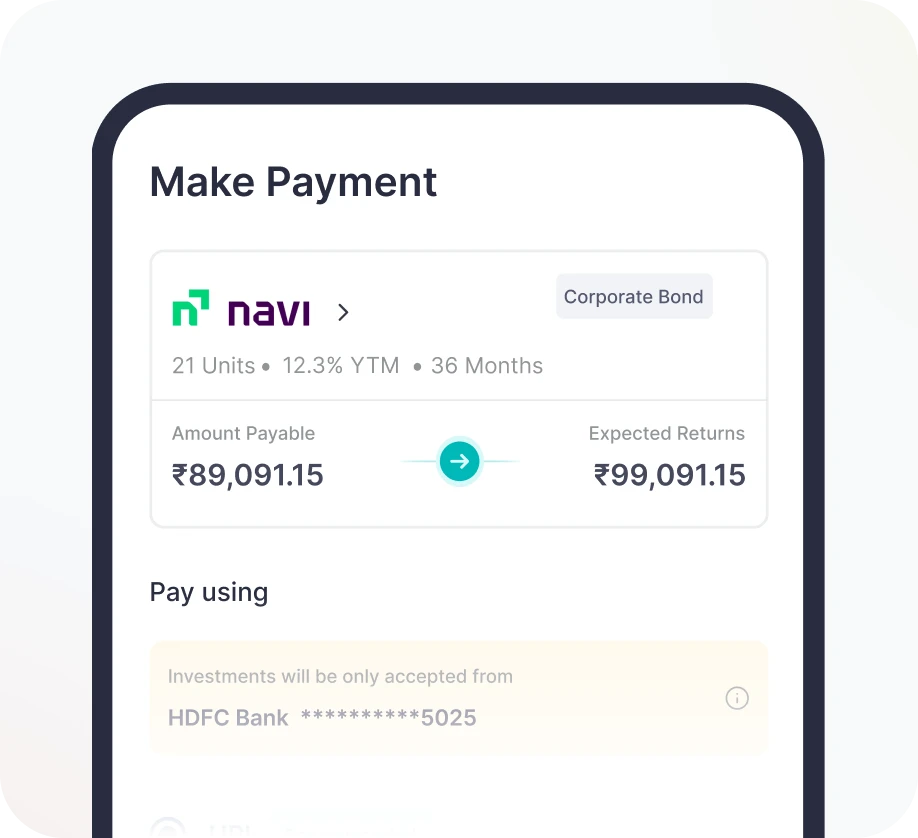

Invest & Pay Securely

All you need to Know about Corporate and Secured Bonds

What are corporate Bonds?

Companies issue corporate bonds to raise finance for various reasons, such as building a new plant, buying equipment or for business expansion. Corporate bonds are generally medium to long-term debt instruments with more than one year of maturity. Whereas debt instruments issued by corporates with a maturity shorter than one year are referred to as commercial paper.

Features of Corporate Bonds in India

Taxable

Interest on corporate bonds is generally taxable.

Credit Rating Criterion

Corporate Bonds can be classified into two types on the basis of Credit Rating: Investment Grade and Non-investment Grade (Junk Bonds). Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bonds; others are considered Non-investment Grade Bonds.

Coupon rate

Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A-rated) coupons in the current year, 2021. On the contrary, G-secs provide a 6% coupon rate. Many times, investors prefer investing considering corporate bonds’ interest rates.

Tenor

Corporate Bonds have shorter tenures as compared to G-secs. Upon maturity of the corporate bond, the investor obtains the principal amount. Until maturity, the money is owed by the investor to the issuer, and during the maturity period, the principal is repaid with any outstanding interest, and the contract gets settled.

Moderate liquidity

The liquidity of the corporate bond market via Over counter is moderate to high, subject to the specific bond. Here, liquidity means the ease of selling the bonds without much price negotiation.

Types of Corporate Bonds

Mortgage Bonds

Different types of assets can be used as collateral to secure bonds. For example, mortgage-backed securities are bonds that are supported by mortgages. With a mortgage bond, bondholders have the option to sell the mortgaged properties to meet any outstanding obligations to bondholders.

Collateral Trust Bonds

Collateral trust bonds and mortgage bonds share similarities, except that collateral trust bonds do not use residential properties as collateral. Businesses employ collateral trust bonds when they lack permanent assets or real estate and instead hold securities from other firms. When issuing bonds, these firms pledge the stocks, bonds, and other interests they own in other companies.

Debenture Bonds

Debenture bonds, including treasury bills in the Corporate Bonds category, are unsecured bonds that lack specific property or asset backing. Companies often issue debenture bonds with favorable credit ratings, resulting in relatively moderate interest rates.

Guaranteed Bonds

Guaranteed bonds, as the name implies, are bonds that come with a guarantee. Another company provides the guarantee, reducing the risk of default as that company has committed to fulfilling the bond's obligations if required.

Valuation of Indian Corporate Bonds

Corporate Bonds are inversely proportional to interest rates as they rise in value with the fall in interest rates, and their value falls with the rise in interest rates. Normally, the longer the maturity, the greater is the percentage of price volatility. Corporate bond fund has its own importance. Investors can take the decision considering essential risk factors.

Upon holding the bond till maturity, the concern for the price fluctuations will be less which is known as market risk or interest-rate risk, because one will get the bond at face, or par value at the maturity. The inverse relationship of the bonds and interest rates means that the bonds are less worthy. When interest rates rise and vice versa that can be described below:

Rise in interest rates

New market issues come up with higher yields as compared to the older securities, making the older ones unworthy. Therefore, the prices will go down.

Decline in interest rates

New bond issues come up in the market with lower yields as compared to the older securities, which makes the older ones, higher-yielding ones, more useful. Hence, the prices will go up.

Selling of bond before maturity

If a person sells a bond before maturity, it makes worth if the prices are high presently or selling at lower rate is unworthy of what it was paid for.

Advantages of Investing in Corporate Bonds

Good Investment Option

Every investor should gauze the risk involved in the investment option chosen for investment prior to making an investment. Corporate Bonds are a good investment option.

Higher Yields

For the investors looking for regular and higher returns corporate bonds are a good choice. In comparison to government bonds, the return in corporate bonds is high. The corporate bonds interest rates are also a major attraction for investors.

Low Risk

Corporate Bonds have a low risk and are not affected by inflation. Investing in corporate bonds with AA+ or above is safe. Also, in case the issuing company is declared bankrupt, bond holders get priority over stock holders.

What are Secured bonds?

Secured bonds are bonds backed by a specific asset(s) owned by the bond issuer. The asset is a recourse for the bond investors in the event of default by the bond issuer.

Are secured bonds risk free?

No, secured bonds are not completely risk free. However, they have a lower risk than Unsecured Bondss

Issuers of secured bonds

Only corporations or companies (both private sector and PSUs) issue secured bonds.

Who should invest in secured bonds?

Investors who value safety in investing should consider buying secured bonds. Secured bonds can help investors to protect their capital and generate stable and regular income.

Risks of investing in secured bonds

The biggest risk of investing in a secured bond is when the issuer defaults and the value of the collateral backing the bond falls below the market value. In such cases, investors will probably recover only a fraction of their investments.

Apart from this, secured bonds are subject to risks related to interest rate, reinvestment of coupon, liquidity and credit default. Holding a secured bond until maturity will help you eliminate interest rate and liquidity risks.

Advantages of investing in secured bonds

The biggest advantage of investing in secured bonds is that added safety due to the presence of collateral. In case of default or bankruptcy, investors are aided by the trustee of the bond and they can fully recover their money.

Capital protection and regular interest payments are some more advantages of investing in secured bonds.

Best Secured Bonds in India

Identifying the best secured bonds for you requires some filtering.

First, you need to decide what credit rating you are comfortable with. If you are an ultra low risk investor, it is better to stick to AAA secured bonds. If you can handle some risk, investing in AA or A secured bonds can be more rewarding to you than AAA secured bonds.

Next, you need to sort the secured bonds in descending order of yield to identify highest yield secured bonds.

Finally, you need to make sure that the maturity date of the shortlisted secured bond is in line with your investment timeframe. This will reduce your chance of selling the bond prematurely. Holding secured bonds until maturity eliminates risks associated with interest rate and liquidity.

What are senior secured bonds?

Every company has a capital structure for their debt. Seniority of debt decides which debt of the company gets paid first.

Senior secured is the most senior debt of any company and senior secured bondholders get paid first. Hence, it is considered to be the safest debt of any company. Further, in case of bankruptcy of the issuer, the senior secured bond holders are paid first after the issuer's assets have been sold off by the trustee.

What is the difference between secured and unsecured bonds?

Secured Bonds

Unsecured Bonds

Backed by specific assets owned by the issuer

Not backed by any tangible asset, just faith in issuer

Private sector companies and PSUs. Only corporate bonds can be secured

Government bonds are always unsecured. Companies may also issue unsecured bonds

Safer than unsecured bonds because bondholders can sell the asset to recover their money

Riskier than secured bonds (exception - government bonds)

What are capital gain bonds under section 54ec

Capital gain bonds under Section 54EC are a way to save on capital gains tax when selling a long-term asset. They are issued by certain government-backed companies, such as the Rural Electrification Corporation (REC), Power Finance Corporation (PFC), and Indian Railways Finance Corporation (IRFC).

How do they work?

Investors can reinvest their capital gains from selling property or land into 54EC bonds within six months.

The capital gain amount invested in the bonds is exempt from tax.

The interest earned on the bonds is taxable.

What are the benefits?

54EC bonds are a stable investment option.

They are backed by the government, so the risk of capital and interest payments is protected.

What are the limitations?

The interest rates on 54EC bonds are lower than other investment options.

There is a five-year lock-in period, which limits liquidity.

Which bonds are eligible?

Bonds issued by Rural Electrification Corporation Limited (REC)

Bonds issued by National Highway Authority of India (NHAI)

Bonds issued by Power Finance Corporation Limited (PFC)

Bonds issued by Indian Railway Finance Corporation Limited (IRFC)

more about bond

All you need to Know about Corporate and Secured Bonds

What are corporate Bonds?

What are corporate Bonds?

Features of Corporate Bonds in India

Features of Corporate Bonds in India

Types of Corporate Bonds

Types of Corporate Bonds

Valuation of Indian Corporate Bonds

Valuation of Indian Corporate Bonds

Advantages of Investing in Corporate Bonds

Advantages of Investing in Corporate Bonds

What are Secured bonds?

What are Secured bonds?

What are senior secured bonds?

What are senior secured bonds?

Are secured bonds risk free?

Are secured bonds risk free?

Issuers of secured bonds

Issuers of secured bonds

Who should invest in secured bonds?

Who should invest in secured bonds?

Risks of investing in secured bonds

Risks of investing in secured bonds

Advantages of investing in secured bonds

Advantages of investing in secured bonds

Best Secured Bonds in India

Best Secured Bonds in India

What is the difference between secured and unsecured bonds?

What is the difference between secured and unsecured bonds?

What are capital gain bonds under section 54ec

What are capital gain bonds under section 54ec

GRIP SPEAKS

More about Corporate and Secured Bonds

FAQ's on Corporate Bonds

How do corporate bonds work?

How do corporate bonds work?

How do corporate bonds work?

Why invest in corporate bonds?

Why invest in corporate bonds?

Why invest in corporate bonds?

What are the risks associated with corporate bonds?

What are the risks associated with corporate bonds?

What are the risks associated with corporate bonds?

What is the minimum investment amount for corporate bonds?

What is the minimum investment amount for corporate bonds?

What is the minimum investment amount for corporate bonds?

Can I sell my corporate bonds before maturity?

Can I sell my corporate bonds before maturity?

Can I sell my corporate bonds before maturity?

What’s the relationship among coporate bond prices, interest rates and yield?

The price of a bond moves in the opposite direction than market interest rates—like opposing ends of a seesaw. When interest rates go up, the price of the bond goes down. And when interest rates go down, the bond’s price goes up. As shown above, a bond’s yield also moves inversely with the bond’s price.

• Yield: The yield of a corporate bond moves inversely with its price.

• Credit rating: The credit rating of a corporate bond can affect its price.

• Maturity date: The maturity date of a corporate bond can affect its price.

• Coupon rate: The coupon rate of a corporate bond can affect its price.

What’s the relationship among coporate bond prices, interest rates and yield?

The price of a bond moves in the opposite direction than market interest rates—like opposing ends of a seesaw. When interest rates go up, the price of the bond goes down. And when interest rates go down, the bond’s price goes up. As shown above, a bond’s yield also moves inversely with the bond’s price.

• Yield: The yield of a corporate bond moves inversely with its price.

• Credit rating: The credit rating of a corporate bond can affect its price.

• Maturity date: The maturity date of a corporate bond can affect its price.

• Coupon rate: The coupon rate of a corporate bond can affect its price.

What’s the relationship among coporate bond prices, interest rates and yield?

The price of a bond moves in the opposite direction than market interest rates—like opposing ends of a seesaw. When interest rates go up, the price of the bond goes down. And when interest rates go down, the bond’s price goes up. As shown above, a bond’s yield also moves inversely with the bond’s price.

• Yield: The yield of a corporate bond moves inversely with its price.

• Credit rating: The credit rating of a corporate bond can affect its price.

• Maturity date: The maturity date of a corporate bond can affect its price.

• Coupon rate: The coupon rate of a corporate bond can affect its price.

Are the returns from corporate bonds guaranteed?

Are the returns from corporate bonds guaranteed?

Are the returns from corporate bonds guaranteed?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

more about bond

All you need to Know about Corporate and Secured Bonds

What are corporate Bonds?

What are corporate Bonds?

Features of Corporate Bonds in India

Features of Corporate Bonds in India

Types of Corporate Bonds

Types of Corporate Bonds

Valuation of Indian Corporate Bonds

Valuation of Indian Corporate Bonds

Advantages of Investing in Corporate Bonds

Advantages of Investing in Corporate Bonds

What are Secured bonds?

What are Secured bonds?

What are senior secured bonds?

What are senior secured bonds?

Are secured bonds risk free?

Are secured bonds risk free?

Issuers of secured bonds

Issuers of secured bonds

Who should invest in secured bonds?

Who should invest in secured bonds?

Risks of investing in secured bonds

Risks of investing in secured bonds

Advantages of investing in secured bonds

Advantages of investing in secured bonds

Best Secured Bonds in India

Best Secured Bonds in India

What is the difference between secured and unsecured bonds?

What is the difference between secured and unsecured bonds?

What are capital gain bonds under section 54ec

What are capital gain bonds under section 54ec

How to Invest in Corporate Bonds in India on Grip Invest

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in Corporate Bonds in India on Grip Invest

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely