Bonds in India

Bonds in India

Explore Bonds in India with Grip Invest. Learn about fixed-income investment options, benefits, and how to diversify your portfolio securely.

Explore Bonds in India with Grip Invest. Learn about fixed-income investment options, benefits, and how to diversify your portfolio securely.

Explore bonds

Explore bonds

Explore bonds

Introduction to Bonds In India

Indian bond investment is one of the trending investment assets in India. The availability of diverse types of bonds seeks to suit the differing requirements of the large investor base in the country. The Indian bond market has expanded by more than 75% from FY 2020-24, in which corporate bonds consistently contributed 21% to 25%. Evaluating this investment option and aligning it with the financial goals can help investors get a potential diversification at a significantly lower cost.

Grip Invest deals

List of Bonds on Grip Invest

BOND Directory

List of Bonds in India

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

Load More

All you need to Know about Bonds in India

What Are Bonds?

India is home to the largest population in the world. Due to this, there is a wide variety of investment aspirations and requirements in the country. Therefore, in modern times, diverse and innovative asset classes are evolving. One such diverse but classic asset class is debt instruments.

Among these, bonds in India have been successful in attracting a significant flock of investors. Bonds are investments that provide debt finance for its issuers in return for fixed income. Bond investment can help earn fixed income based on the interest rate, called coupon rate. Moreover, being a debt instrument, it is a crucial obligation for the issuer.

Compared to assets like equities and alternative investment options, bonds are less risky. Here we are talking about investment-grade bonds which have a rating of BBB+ or above.

The Indian Bond Market: Overview

Investors in India are growingly attracted to the bond market due to its core features and variety. As of FY 2024, the Indian bond market was valued at INR 217 trillion. Among the different types of bonds, corporate bonds became a significant attraction for investors due to their market exposure. They contribute nearly 21% to 25% of the total bond market.

Source: NSE Corporate Bonds Market

The recent government reforms, market sentiments and product innovations indicate a strong growth trajectory for corporate bonds in India in the upcoming years. From approximately INR 47 trillion, this market is expected to reach the mark of INR 100-120 trillion in FY 2030, indicating the Compounded Annual Growth Rate (CAGR) of 13.4% to 17%.

The current market can be a sweet spot for easing government reforms, and potential growth runs for investors to enter.

Types of Bonds

Investors can explore a diverse range of bond types to match their investment aspirations. Here are some of the common types of bonds:

Corporate Bonds

These are issued by corporations or companies. Usually, they provide high-interest income due to their market exposure. Moreover, investors can select the bonds according to risk tolerance by also checking their credit ratings. The investment process of corporate bonds in India has become simple due to the availability of OBPPs, which are regulated bond offering platforms. Additionally, authorities have also taken initiatives to make the bond market in India more attractive by reducing the minimum investment amount to INR 10,000 for privately placed corporate bonds.

Zero-Coupon Bonds

These bonds do not generate any interest income. Investors invest at a lower rate price than face value to realise the difference after maturity. Generally, they are used for capital protection.

Government Bonds

These bonds are issued by the central and state governments and are popular for this sovereign backing. Moreover, they may generate lower returns due to safety priority.

Callable Bonds

They allow issuers to buy back their bonds before maturity from the investors.

High-Yield Bonds

These corporate bonds have a high coupon rate but are suitable for investors with a high-risk appetite. They are also rated lower than the investment-grade bonds.

Perpetual Bonds

These bonds do not have a fixed maturity date and provide a steady and fixed interest.

Why Invest in Bonds?

Investing in bonds can be a crucial decision to diversify the investment portfolio and have a potential income source. Here is how a bond investment can transform an investment journey in many ways:

Fixed Income

Bond instrument provides a stable income source in the form of interest. The coupon rate in bonds indicates potential annual income from the instrument.

Credit Rating

Specific credit rating agencies or CRAs assign credit ratings based on the issuer, type, and other fundamentals of a bond. These ratings can simplify the investment process as it helps investors analyse risk levels.

Easy Entry

Investors can easily invest as low as INR 1,000 in the bonds. Moreover, registered bond platforms, like Grip Invest, and other brokerage firm apps ease this process at many levels.

Bond Market In India

In FY 2024, the bond market grew by 12.4% and its projected growth is also high. Hence, this is the right time for investors to enter the Indian corporate bond market.

Investing in bonds can be a crucial decision to diversify the investment portfolio and have a potential income source. Here is how a bond investment can transform an investment journey in many ways:

How Bonds Can Help Diversify Your Portfolio?

In modern times, there are different types of bonds with varied ratings and risk levels. Investors can follow these steps to diversify their portfolio with a bond investment:

Identify your investment objective and tenure

Investment objectives can be for capital appreciation, regular income, particular market exposure, and more. Tenure also can differ based on the requirements of an investor. For example, if an investor is willing to get market exposure with fixed extra income like interest, corporate bonds can be a potential choice.

Ascertain your risk profile

Investors can be risk averse, neutral or seeking. It will also help select the types of bonds for investment. Moreover, one can assess the risk level of bonds based on the other investments in their portfolio.

Check its credit rating

Based on the safety aspect of a bond, it can be rated from AAA to D as follows:

Credit Rating

Description

AAA

Highest safety with the lowest credit risk.

AA

High safety and timely management of obligations.

A

Adequate safety levels.

BBB

Medium credit quality.

BB

Moderate quality and default risk.

B

Significant default risk.

C

High default risk.

D

Expected to default soon. Lowest safety.

Investors can check the meaning of these ratings and select a particular bond by evaluating their existing and desired safety levels for the portfolio.

Select the authorised platform

Investors should only select the authorised platform for their investments to safeguard their hard-earned money. Moreover, it can also simplify the above-mentioned process. OBPP (Online Bond Platform Provider), like Grip Invest, should be the first choice for bond investments as it offers only rated, regulated and secured investment-grade bonds. You can pick from a diverse range of bonds with ratings from BBB+ to AAA on Grip Invest.

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

Risks And Challenges Of Bond Investment

Every investment is accompanied by some risk that can hamper its growth trajectory. In a bond investment, investors may face the following hurdles:

Credit Risk

All the debt instruments carry this inherent risk. It arises when the issuer fails to repay even the principal amount. Therefore, selecting a reliable issuer is crucial.

Liquidity Risk

In case of a lack of buyers due to unattractive bond yield or lack of safety, selling a bond can become difficult.

Interest Rate Risk

A bond price and interest rate follow an inverse relationship. Therefore, when interest rates drop, the bond price increases and vice versa. Growing yield bonds can adversely affect the bond price for existing investors.

Inflation Risk

When investors focus on safety in bonds, they may earn lower yields. It can eventually fall short in the conditions of rising inflation. Investors should seek to balance their investments by considering this factor.

Taxation Liability

The tax on debt securities is levied based on its holding period and listing status. The interest earned from these assets is credited after deducting 10% Tax Deducted at Source (TDS). The tax on capital gains is as follows:

Bonds

Holding period

Short-Term Capital Gains

Long-Term Capital Gains

Listed Bonds

12 months

Income Tax Slab Rate

12.5% without indexation

Unlisted Bonds

24 months

Income Tax Slab Rate

Income Tax Slab Rate

External Factors

Government norms, geo-political conditions, oil prices, currency exchange rates and much more can affect the investment market. The bond market can also be part of it.

more about bond

All you need to Know about Bonds in India

All you need to Know about Bonds in India

Can I invest INR 1,000 in bonds?

Can I invest INR 1,000 in bonds?

Can I invest INR 1,000 in bonds?

The Indian Bond Market: Overview

The Indian Bond Market: Overview

The Indian Bond Market: Overview

Types of Bonds

Types of Bonds

Types of Bonds

Why Invest in Bonds?

Why Invest in Bonds?

Why Invest in Bonds?

How Bonds Can Help Diversify Your Portfolio?

How Bonds Can Help Diversify Your Portfolio?

How Bonds Can Help Diversify Your Portfolio?

Risks And Challenges Of Bond Investment

Risks And Challenges Of Bond Investment

Risks And Challenges Of Bond Investment

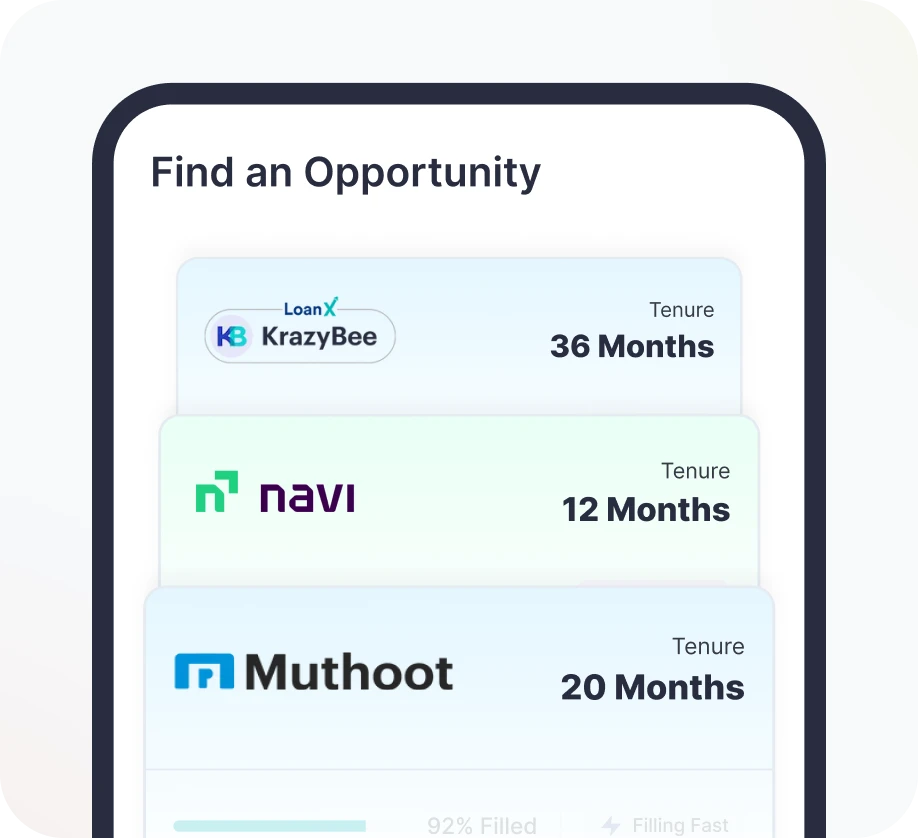

How to Invest in Bonds Through Grip Invest?

Investing in bonds with an authorised platform like Grip Invest can simplify the process to a greater extent. Investors can explore a diverse range of available options, compare them, filter the results and invest accordingly. Moreover, Grip Invest can also keep investors updated on market conditions and regulatory changes.

1

Sign up to Grip Invest.

Sign up to Grip Invest to browse through AAA rated bonds.

2

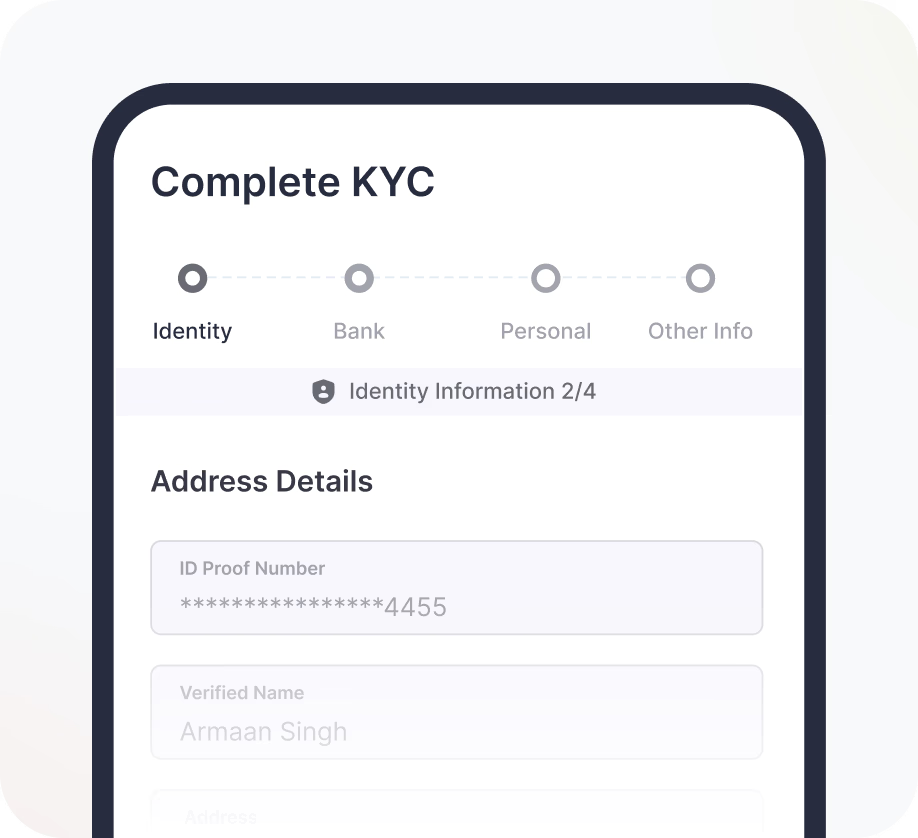

Complete KYC and Begin Your Journey

3

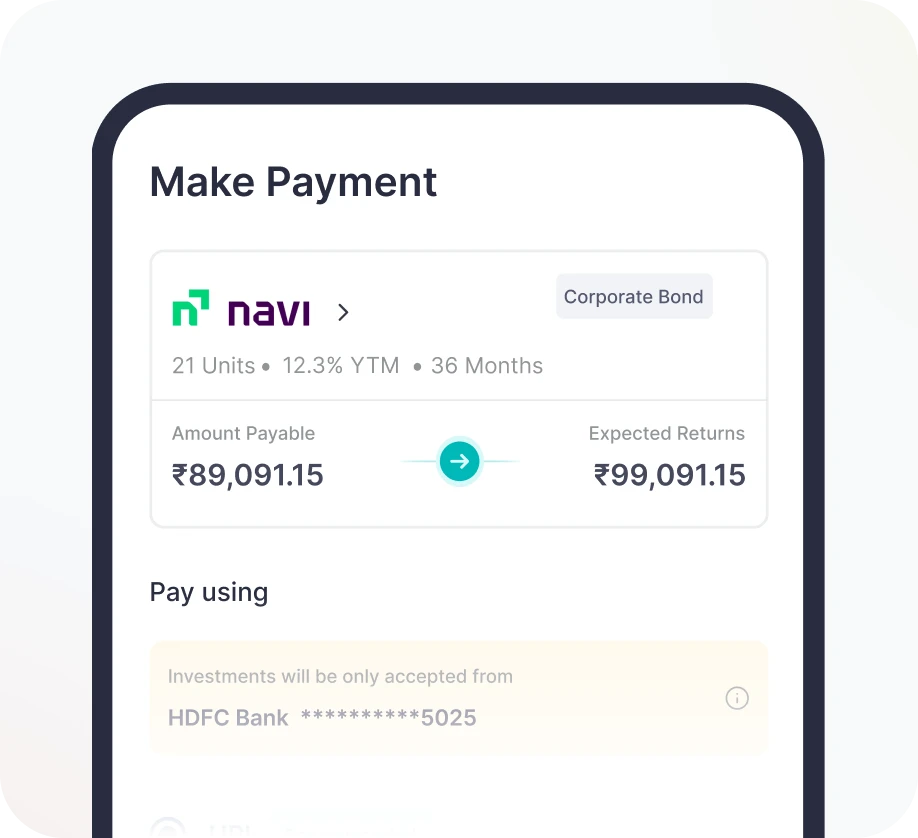

Invest & Pay Securely

Conclusion

Unlocking The Potential of Bond Investments In India

The Indian bond market is all set to grow at a potential pace in the upcoming years, and investors can become part of this growth. Bonds can help investors earn interest income with capital appreciation. Moreover, it can diversify its portfolio to balance the overall risk-return levels. Investors should analyse the risk and seek to manage it while investing in bonds.

Are you ready to diversify your portfolio with a bond investment? Log in to Grip Invest and start your investment journey today!

GRIP SPEAKS

More about Bonds

Understanding Taxation on Bonds

9 mins read

Grip Invest Jan 02, 2025

Bonds

Corporate Bonds In India With Regulatory Reforms!

8 mins read

Grip Invest Nov 21, 2024

Bonds

Exploring Different Types Of Bonds: A Complete Guide

12 mins read

Grip Invest Jan 30, 2025

Bonds

Listed Bonds Vs. Unlisted Bonds: A Comprehensive Comparison

7 mins read

Grip Invest Jan 14, 2025

Bonds

What are Investment Grade Bonds

6 mins read

Grip Insights

Grip Invest Jan 07, 2025

Bonds

Investment Grade Vs. Non-Investment Grade Bonds

6 mins read

Grip Insights

Grip Invest Dec 10, 2021

Bonds

FAQ's on Bonds

Can I invest INR 1,000 in bonds?

Can I invest INR 1,000 in bonds?

Can I invest INR 1,000 in bonds?

Which bonds are not taxable?

Which bonds are not taxable?

Which bonds are not taxable?

How can I Invest in bonds in India?

How can I Invest in bonds in India?

How can I Invest in bonds in India?

Who should buy high-yield bonds in India?

Who should buy high-yield bonds in India?

Who should buy high-yield bonds in India?

Are bonds in India a safe investment option?

Are bonds in India a safe investment option?

Are bonds in India a safe investment option?

What are the tax implications of investing in bonds in India?

What are the tax implications of investing in bonds in India?

What are the tax implications of investing in bonds in India?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in AAA-Rated Bonds Through Grip Invest?

How to Invest in Bonds Through Grip Invest?

How to Invest in Bonds Through Grip Invest?

Grip Invest provides a range of corporate bonds for investment. Investors can follow these steps to invest in AAA bonds through Grip Invest:

Investing in bonds with an authorised platform like Grip Invest can simplify the process to a greater extent. Investors can explore a diverse range of available options, compare them, filter the results and invest accordingly. Moreover, Grip Invest can also keep investors updated on market conditions and regulatory changes.

Investing in bonds with an authorised platform like Grip Invest can simplify the process to a greater extent. Investors can explore a diverse range of available options, compare them, filter the results and invest accordingly. Moreover, Grip Invest can also keep investors updated on market conditions and regulatory changes.