Buy Tax Free Bonds In India

Tax-free bonds can offer interest income, tax-shield and security for a portfolio. Explore its options and diversify your portfolio today!

Explore tax-free bonds

What Are Tax-Free Bonds?

There are different aspects of an investment that affect the investment decision. They mainly include investment objectives, market exposure, risk, taxation and time horizon. Managing them all simultaneously can increase the investment cost. One such crucial cost is tax. It can account for a significant chunk of the total income.

Tax-free bonds are a potential solution to this issue. Similar to other debt instruments, they will generate frequent interest income and capital gains at maturity. However, their tax-free nature sets them apart from other bonds. They allow investors to claim income tax exemption for their interest income.

The minimum investment for tax-free bonds is INR 1,000, and the maximum investment is INR 10 lakhs for retail investors. Governments, municipalities, public sector units or corporations issue such bonds.

BOND Directory

List of Tax-Free Bonds in India

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

All you need to Know about Bonds in India

Historical Context Of Tax-Free Bonds

Tax-free bonds in India are comparatively a fresh investment avenue. This 13-year-old (as of FY 2025) investment instrument has played a crucial role in attracting investors towards the bond market.

Origin And Evolution Of Tax-Free Bonds In India

In India, tax-free bonds were first issued in FY11-12 to raise a corpus of INR 30,000 crore. Further, it was issued in the subsequent years as follows:

Tax-Free Bonds Issues in Previous Financial Year

Financial Year

Amount Allocated for Tax free Bonds (In ₹ Cr)

2011-2012

30000

2012-2013

60000

2013-2014

50000

2014-2015

Nil

2015-2016

40000

The government departments and PSUs issued their last tax-free bonds in FY 15-16. The tenure for these bonds spanned for 10, 15 or 20 years.

Key Milestones In The Bond Market

The Indian bond market has been in momentum for the past few years and has attracted significant traffic. After the last issue of tax-free bonds, 2015-16, the bond market has significantly evolved. Some of the key milestones achieved in this tenure were the bond market surpassing the INR 100 trillion mark, a boost to the digital economy, the introduction of the RBI Retail Direct platform, and the inclusion of the government in the global bond index. These aspects have brought significant evolution in the overall bond market.

Changes In Regulation And Policies Over Time

The regulatory reforms have significantly contributed to the ease of bond investments in India. Tax-free bonds are one such innovation which provides relief in tax regulations. Apart from this, some of the structural changes are as follows:

Reduction in face value from INR 1 lakh to INR 10,000 and INR 1000 can attract significant retail participation.

Electronification of secondary bond trading.

The establishment of a framework for online bond platforms has encouraged ease of digital investment in bonds.

Who Issues Tax-Free Bonds?

Tax-free bonds in India can be issued by the central government, specific departments, state governments, municipalities and public sector units (PSUs). Usually, these entities raise funds from tax-free bond issuance for specific purposes such as infrastructure development, green projects, and more.

Importance Of Tax-Free Bonds For Investors

The key characteristic of a tax-free bond is the exemption of its interest from tax liability. It plays a crucial role in reducing the calculation of the overall taxable income. Moreover, this debt instrument is usually issued by governments or PSUs, which provides a sense of sovereign security for the investments. Investors can also opt for tax-free bonds to earn frequent interest income, protect capital for the long term and reduce the tax incidence with this interest income.

Types Of Tax-Free Bonds In India

Tax-free bonds can be a potential addition to the portfolio with tax-free interest income. These can be further categorised based on their issuer into government, municipal, and corporate bonds.

Government-Issued Tax-Free Bonds

These are issued by the central or state governments or their departments for specific purposes. They focus significantly on security and can be highly rated bonds. For example, bonds issued by the National Highway Authority of India.

Municipal bonds

These bonds are issued by specific municipalities for purposes like infrastructure, cleaning, public programmes or facility installation in their particular municipality.

Tax free corporate bonds

In India, these bonds are usually issued by the PSUs. They provide the desired market exposure and can be more liquid than other types. For example, tax-free corporate bonds issued by the Power Finance Corporation of India.

Advantages Of Investing In Tax-Free Bonds

Some of the key benefits of tax-free bonds are as follows:

The annual interest earned from this investment can be claimed as an exemption under Section 10 of the Income Tax Act, 1961.

Investors with higher brackets may find this investment attractive to reduce their taxable income.

The sovereign-backing provides security for the overall portfolio.

It is suitable for specific long-term financial objectives like higher education, house purchase, retirement planning, and more.

Disadvantages Of Investing In Tax-Free Bonds

Despite the attractive benefits of these instruments, investors should also consider certain risks and take due measures to address them:

Interest rates can be low due to tax benefits and security.

These assets have a long maturity period and are less liquid compared to other bonds.

The low interest rates may be outpaced by inflation.

Since the past few years, no new tax-free bonds have been issued.

Only the interest from these bonds can be claimed in the exemption. The capital gains are taxable as per the capital gains tax norms.

Key Considerations Before Investing

Every investment is a significant part of building financial viability for an individual, and demands required efforts for analysis and decision-making. Therefore, investors should consider some of the key points while deciding whether tax-free bonds are suitable for them.

Understanding The Market

The overall bond market, its conditions and market dynamics should be studied before investing the tax-free bonds.

Eligibility And Investment Limit

Investors can invest as low as INR 1,000 in these bonds. However, one should check their suitability for long-term investment with an emphasis on security and tax benefits rather than returns.

Assessing Risk And Return Expectations

The tax-saving bonds may be significantly affected by inflation and liquidity risks. Therefore, investors should plan allocation for these bonds in their portfolios.

Who Should Invest In Tax-Free Bonds?

Investors willing to protect their capital for the long term, along with moderate market returns, can seek investment in tax-free bonds. Moreover, the tax exemption can reduce the overall tax liability. Therefore, investors with high tax brackets can reduce their taxable income and lower their tax burden. These bonds will be suitable for long-term goals such as higher education and retirement planning.

List Of Tax-Free Bonds Available In India.

Investors can explore some of these tax-free bonds in India to diversify their portfolios

Name

Coupon Rate (%)

National Housing Bank

9.01%

Power Finance Corporation Ltd.

8.92%

NTPC Ltd.

8.91%

National Housing Bank

8.88%

Power Finance Corporation Ltd.

8.79%

National Housing Bank

8.76%

National Highways Authority of India

88.75%

NTPC Ltd.

8.73%

Rural Electrification Corporation Ltd.

8.71%

National Housing Bank

8.68%

How to Invest in Tax-Free Bonds Through Grip Invest?

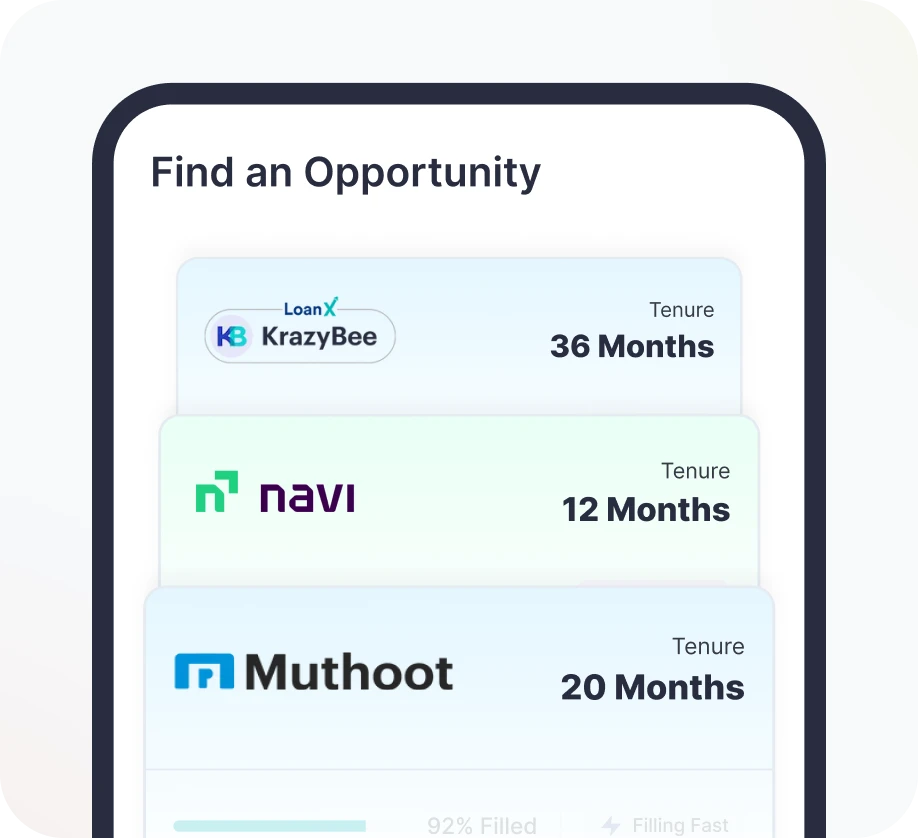

Investors can explore tax-free bonds through authorised stock exchanges, RBI Retail Direct, banking websites or applications, brokers, and authorised platforms like Grip Invest. Investing with authorised bond platforms can help explore, analyse and select the most suitable tax-free bonds for their portfolios. Investors can follow these steps:

1

Sign up to Grip Invest.

Sign up to Grip Invest with your email and phone number to browse through Tax-Free bonds.

2

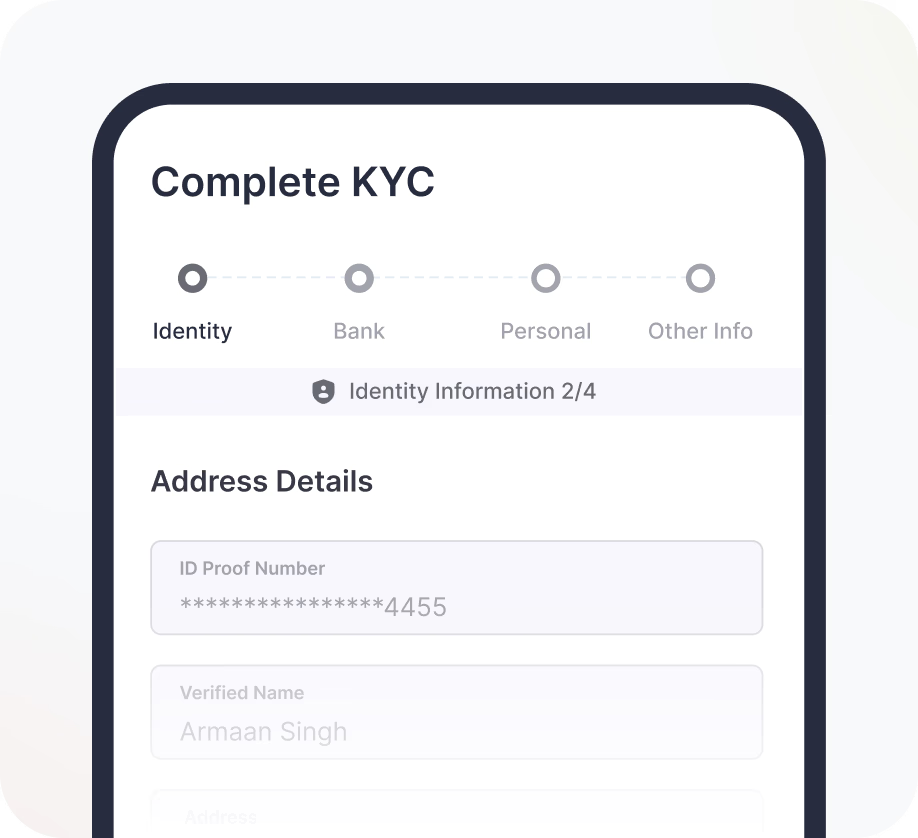

Complete KYC and Begin Your Journey

3

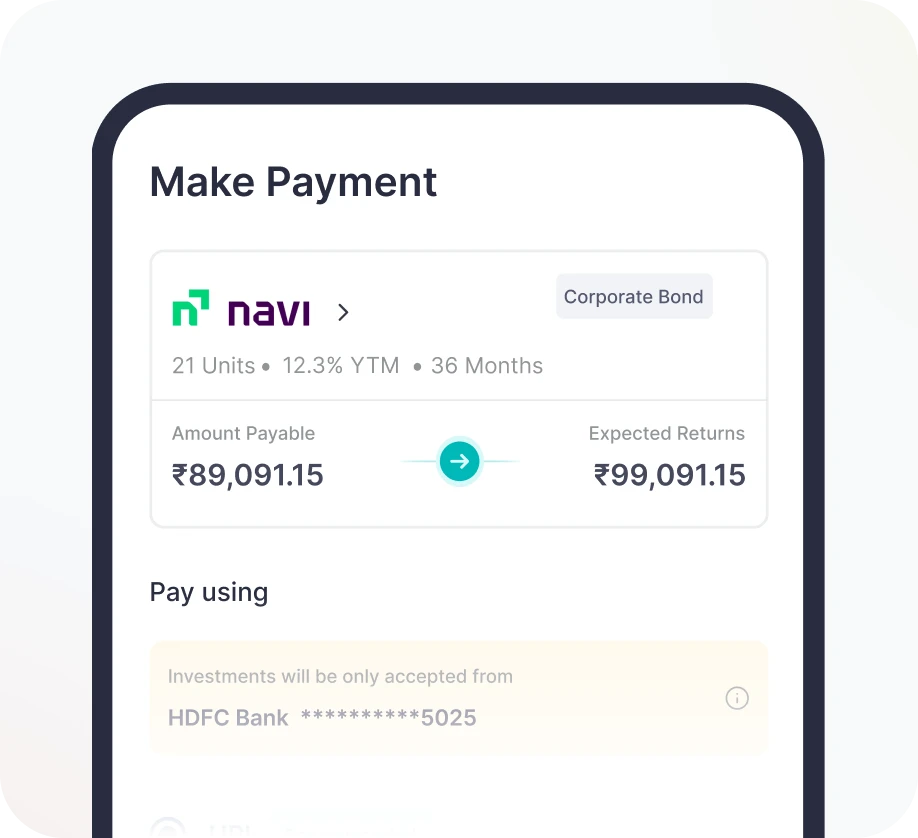

Invest & Pay Securely

Conclusion

Tax-free bonds offer a unique investment opportunity for the portfolio with tax benefits. The interest from these instruments can be claimed as an exemption. Its long-term nature helps fulfil financial objectives with sovereign security. However, investors should analyse their risks and take measures to manage them.

Planning to start your corporate bond investment? Log in to Grip Invest and start your investment journey today!

GRIP SPEAKS

More about Tax-Free Bonds

FAQ's on Tax-Free Bonds

Which are the best tax-free bonds in India?

Which are the best tax-free bonds in India?

Which are the best tax-free bonds in India?

What is the minimum and maximum investment amount in tax-free bonds?

What is the minimum and maximum investment amount in tax-free bonds?

What is the minimum and maximum investment amount in tax-free bonds?

How to identify the best tax-free bonds?

How to identify the best tax-free bonds?

How to identify the best tax-free bonds?

Are tax-free bonds safe to invest in?

Are tax-free bonds safe to invest in?

Are tax-free bonds safe to invest in?

What types of investors are suitable for tax-free bonds?

What types of investors are suitable for tax-free bonds?

What types of investors are suitable for tax-free bonds?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

more about bond

All you need to Know about High-Yield Bonds

Who Issues Tax-Free Bonds?

Who Issues Tax-Free Bonds?

Historical Context Of Tax-Free Bonds

Historical Context Of Tax-Free Bonds

Importance Of Tax-Free Bonds For Investors

Importance Of Tax-Free Bonds For Investors

Advantages Of Investing In Tax-Free Bonds

Advantages Of Investing In Tax-Free Bonds

Types Of Tax-Free Bonds In India

Types Of Tax-Free Bonds In India

Disadvantages Of Investing In Tax-Free Bonds

Disadvantages Of Investing In Tax-Free Bonds

Key Considerations Before Investing

Key Considerations Before Investing

Who Should Invest In Tax-Free Bonds?

Who Should Invest In Tax-Free Bonds?

List Of Tax-Free Bonds Available In India.

List Of Tax-Free Bonds Available In India.

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in Tax-Free Bonds Through Grip Invest?

Investors can explore tax-free bonds through authorised stock exchanges, RBI Retail Direct, banking websites or applications, brokers, and authorised platforms like Grip Invest. Investing with authorised bond platforms can help explore, analyse and select the most suitable tax-free bonds for their portfolios. Investors can follow these steps:

Buy Tax Free Bonds In India

Tax-free bonds can offer interest income, tax-shield and security for a portfolio. Explore its options and diversify your portfolio today!

Explore tax-free bonds

What Are Tax-Free Bonds?

There are different aspects of an investment that affect the investment decision. They mainly include investment objectives, market exposure, risk, taxation and time horizon. Managing them all simultaneously can increase the investment cost. One such crucial cost is tax. It can account for a significant chunk of the total income.

Tax-free bonds are a potential solution to this issue. Similar to other debt instruments, they will generate frequent interest income and capital gains at maturity. However, their tax-free nature sets them apart from other bonds. They allow investors to claim income tax exemption for their interest income.

The minimum investment for tax-free bonds is INR 1,000, and the maximum investment is INR 10 lakhs for retail investors. Governments, municipalities, public sector units or corporations issue such bonds.

BOND Directory

List of Tax-Free Bonds in India

Name

Coupon

Load More

Load More

more about bond

All you need to Know about High-Yield Bonds

Who Issues Tax-Free Bonds?

Who Issues Tax-Free Bonds?

Historical Context Of Tax-Free Bonds

Historical Context Of Tax-Free Bonds

Importance Of Tax-Free Bonds For Investors

Importance Of Tax-Free Bonds For Investors

Advantages Of Investing In Tax-Free Bonds

Advantages Of Investing In Tax-Free Bonds

Types Of Tax-Free Bonds In India

Types Of Tax-Free Bonds In India

Disadvantages Of Investing In Tax-Free Bonds

Disadvantages Of Investing In Tax-Free Bonds

Key Considerations Before Investing

Key Considerations Before Investing

Who Should Invest In Tax-Free Bonds?

Who Should Invest In Tax-Free Bonds?

List Of Tax-Free Bonds Available In India.

List Of Tax-Free Bonds Available In India.

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in Tax-Free Bonds Through Grip Invest?

Investors can explore tax-free bonds through authorised stock exchanges, RBI Retail Direct, banking websites or applications, brokers, and authorised platforms like Grip Invest. Investing with authorised bond platforms can help explore, analyse and select the most suitable tax-free bonds for their portfolios. Investors can follow these steps:

Conclusion

Tax-free bonds offer a unique investment opportunity for the portfolio with tax benefits. The interest from these instruments can be claimed as an exemption. Its long-term nature helps fulfil financial objectives with sovereign security. However, investors should analyse their risks and take measures to manage them.

Planning to start your corporate bond investment? Log in to Grip Invest and start your investment journey today!