Debentures - Fixed Income Investments!

Debentures - Fixed Income Investments!

Explore the range of credit-rated debentures that offer fixed returns and portfolio stability at a comparatively lower risk than equity!

Explore the range of credit-rated debentures that offer fixed returns and portfolio stability at a comparatively lower risk than equity!

Explore Debentures bonds

What Are Debentures?

Debentures are debt instruments issued by companies to raise capital for business expansion or operations. Their credibility depends on the issuer and, in some cases, may be backed by collateral.

BOND Directory

List of Debentures in India

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

Load More

All you need to know about Debentures in India

Key Features Of Debentures

Debentures are popular securities with a range of characteristics. Any issue of debentures has the following traits.

Maturity

Debentures have a set due date for principal and interest repayment. In essence, debenture investments are a kind of debt. Therefore, the principal and total accrued interest must be repaid and cannot continue till perpetuity.

Interest

Like any other debt security, debentures carry interest. However, the interest on debentures can be fixed or variable. Fixed interest remains constant irrespective of market conditions. Variable interest fluctuates based on a given formula.

Rights

Debenture-holders are repaid before shareholders if a company ceases to exist because they are creditors. However, unlike shareholders, debenture-holders do not carry any voting rights.

Transfer

Debentures in India are generally transferable. This suggests that they are available for secondary market trading. This adds to the liquidity of debenture investments.

Credit rating

The ratings assigned to the debentures by reputed credit rating agencies like CRISIL, ICRA India Ratings, etc., might act as a direct indication of their creditworthiness. One of the most commonly used credit rating systems for debentures is a letter-based scale. The table below shows one of the most widely recognized scales, as provided by CRISIL.

Credit Rating

Description

AAA

Highest safety with the lowest credit risk.

AA

High safety and timely management of

obligations.

A

Adequate safety levels.

BBB

Medium credit quality.

BB

Moderate quality and default risk.

B

Significant default risk.

C

High default risk.

D

Expected to default soon. Lowest safety.

Types Of Debentures

The wide range of debenture investments allows investors to choose the investment avenue that best meets their financial goals and values.

Based On Security

Debentures in India can be divided into two groups according to security.

1. Secured Debentures

If the issue of debentures is backed by collateral, it is called a secured debenture. Either a particular asset (fixed charge) or all assets (floating charge) of the company act as collateral. If the issuer can't pay back the debenture-holders, the asset will be liquidated.

2. Unsecured Debentures

The issue of debentures that is not backed by any security is called unsecured debentures. The credibility of the issuing company acts as a guarantee of the issue. Unsecured debentures often offer higher interest than secured debentures due to their heightened risk.

Based On Tenure

Debentures can be classified into two categories based on the repayment tenure.

1. Redeemable Debentures

Debenture investments that carry a specific maturity date by which the company has to repay the principal along with interest are called redeemable debentures.

2. Irredeemable Debentures

Debenture investments that do not have any fixed maturity date are called irredeemable debentures. They usually continue till perpetuity, that is, till the liquidation of the company.

Based On Convertibility

Depending on their convertibility, debentures may be divided into two groups.

1. Convertible Debentures

The issue of debentures that can be transformed into equity shares after a specific tenure is called convertible debentures. There are two types of convertible debentures.

The full value of debenture investments can be converted into equity shares by holders of fully convertible debentures.

A part of debenture investments may be transformed into equity shares through partially convertible debentures.

2. Non-Convertible Debenture (NCD)

Debentures that are not available for conversion into equity shares after a certain tenure are known as non-convertible debentures.

Based On Registration

Debentures in India can be categorized into two categories based on the ownership and transferability recording process.

1. Registered Debentures

If the company registers and records the details of debenture holders, resulting in the requirement of a transfer deed for ownership changes, it is called registered debentures.

2. Bearer Debentures

In the case of unregistered debentures or bearer debentures, the company does not keep any record and ownership change happens through the delivery of debentures alone.

Based On Coupon Rate

The interest rate paid to debenture-holders by the issuer of debentures is called the coupon rate. Based on it, debentures can be categorized into three categories.

1. Specific Coupon Rate Debentures

If the interest on debentures remains fixed throughout the life of the instrument, the debenture is called a specific coupon rate debenture.

2. Zero Coupon Rate Debentures

If a debenture is issued at a discount rather than carrying any interest, it is called a zero coupon rate debenture. The return is the gap between the issue rate and the nominal value of the debenture, i.e., the discount.

3. Floating Rate Debentures

If the interest on debentures varies with the fluctuating market conditions, the debenture investment is called floating rate debentures. Although it is not strictly a coupon rate classification, this category of debentures differs based on the interest rate.

Advantages Of Investing In Debentures

Debentures in India are a prominent investment avenue and carry the following benefits.

Constant Returns

Most debentures offer fixed interest payments, ensuring predictable returns.

Risk

Debentures are less risky than equity because they are a type of debt instrument, and companies are obligated to repay debenture-holders before equity holders.

Liquidity

The secondary market allows for the trading of debentures. Debenture-holders need not wait till the maturity date to liquidate their investment.

No Dilution Of Ownership

Companies can raise funds for their sustenance or expansion through the issue of debentures without diluting their ownership.

Convertibility

Convertible debentures uphold investor choice and freedom by giving them the option to convert their investment into equity shares that carry greater returns. Only convertible debentures offer this benefit.

Credit Rating

Debentures are rated by top credit rating agencies like ICRA and CRISIL. It helps investors judge the creditworthiness of the instrument.

Risks Associated With Debentures

Awareness regarding the risks related to a particular investment enables the maintenance of caution during investment. The risks related to debentures are listed below

Credit Risk

The financial health of the company determines its ability to repay the principal along with interest. Credit rating plays a crucial role in navigating credit risk.

Market Risk

This risk primarily influences the floating interest debentures and zero-coupon rate debentures. The secondary market is prone to volatility that impacts the liquidation of debentures.

Liquidity Risk

This risk influences the holder’s ability to sell their debentures in the secondary market. Unfavourable market conditions also influence this risk.

Inflation Risk

In the case of fixed interest debentures, the interest on the issue of debentures might not rise with the rise in inflation, causing capital erosion.

Reinvestment Risk

Investors may not be able to reinvest the returns at similar interest rates after maturity.

Debentures vs. Bonds vs. Shares vs. Loans

Parameter

Debentures

Bonds

Shares

Loans

Definition

It is a type of debt instrument issued by public and private companies.

It is a type of debt instrument issued by the government, municipality or companies.

It is a security that represents a unit of ownership in the company.

It is a debt extended by banks, NBFCs or other entities with or without collateral.

Issuer

Usually issued by private companies and public sector undertakings.

Issued by companies and governments.

Issued by companies operating in the private and public sectors.

Issued by banks and other financial institutions.

Nature of investment

Debt to the corporation.

Debt to the corporation.

Ownership of the corporation.

Debt to the corporation.

Convertible

Can be transformed into equity shares.

Convertible bonds can be transformed into equity shares. Most bonds are non-convertible.

Shares cannot be transformed into bonds or debentures.

Loans might use shares as collateral, but cannot be transformed into debentures. Bonds or shares.

Collateral

Debentures can be issued against collateral.

It can also be issued against collateral.

Shares are not issued against collateral.

Loans can also be issued against collateral.

Voting Rights

Do not carry voting rights.

Do not carry voting rights.

Carry voting rights.

Do not carry voting rights.

Liquidation

Priority over debenture-holders.

Priority over shareholders.

Equity shareholders are repaid after the repayment of debt and preference shares.

Generally prioritised before debenture-holders, depending on collateral and terms.

Debenture Redemption Reserve (DRR)

A mandatory reserve fund created by companies that issue debentures in India for utilisation during repayment is called a debenture redemption reserve. Section 71 (4) of the Companies Act 2013 lays out the details of DRR.

The existence of DRR provides liquidity assurance and boosts investor confidence by ensuring investor protection. It provides a clear route for repayment. After an amendment to the Companies Act, listed companies and NBFCs are now exempt from creating a DRR for the public issue of debentures.

Taxation Aspects of Debentures

After the Finance Act of 2023, TDS is deductible on debenture interest at the rate of 10%. However, the TDS will become nil if forms 15G and 15H have been submitted by the individual or HUF. This applies to resident individual investors, and interest income is taxable under “Income from Other Sources”.

It is also important to note that if an individual does not have a valid PAN, their TDS will increase to 20%.

Who Should Consider Investing In Debentures ?

The success of investment for any investor is influenced to a great extent by their choice of the right investment avenue that is in line with the financial goals and temperament of the investor.

The following categories of investors might consider debentures as an investment avenue.

Security-centric Investors

Debentures are often secured by a charge on assets. Moreover, being a debt instrument, they are repaid before equity in case of company liquidation.

Investors Exploring Greater Choice

There is a wide range of debentures available in the market. Moreover, after a certain tenure, debentures may be transformed into equity shares. Therefore, investors who wish for greater flexibility in their investments might explore debenture investments.

Passive Income

Debentures often carry fixed income. Therefore, it can help generate a passive income stream for investors.

Tax-conscious Investors

TDS on debenture investment can become nil if the individual or HUF submits appropriate 15G or 15H forms.

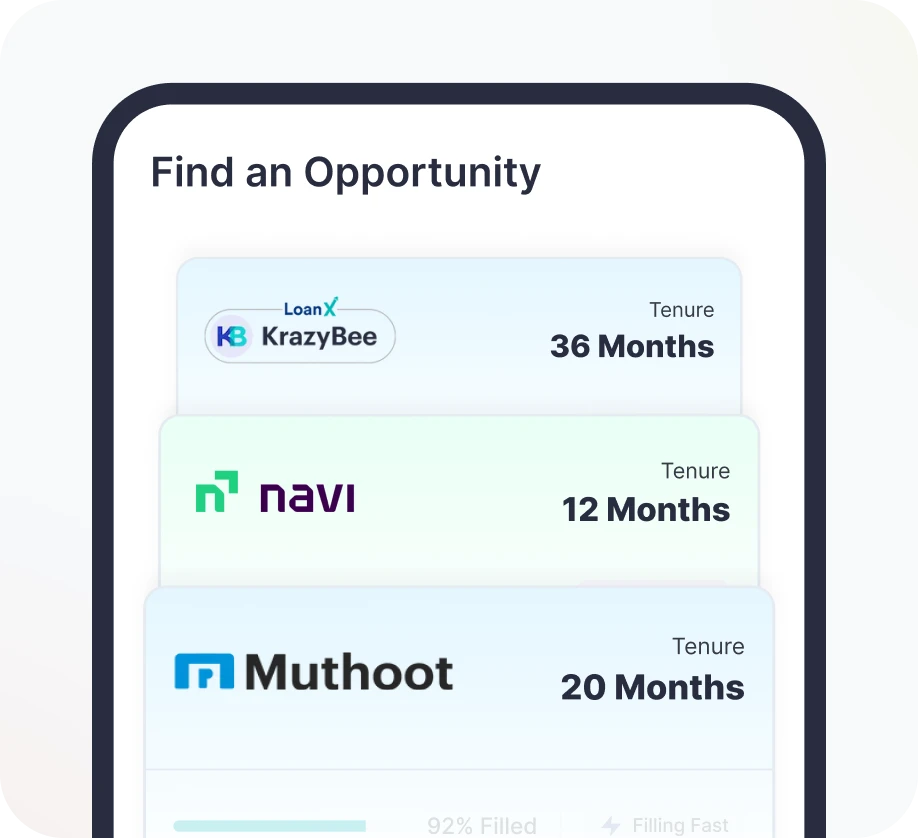

How To Invest In Debentures In India

The process of investing in debentures in India has been simplified by GRIP. Follow the steps below to make a debenture investment.

1

Sign up to Grip Invest.

Sign up to Grip Invest with your email and phone number to browse through debentures investments available.

2

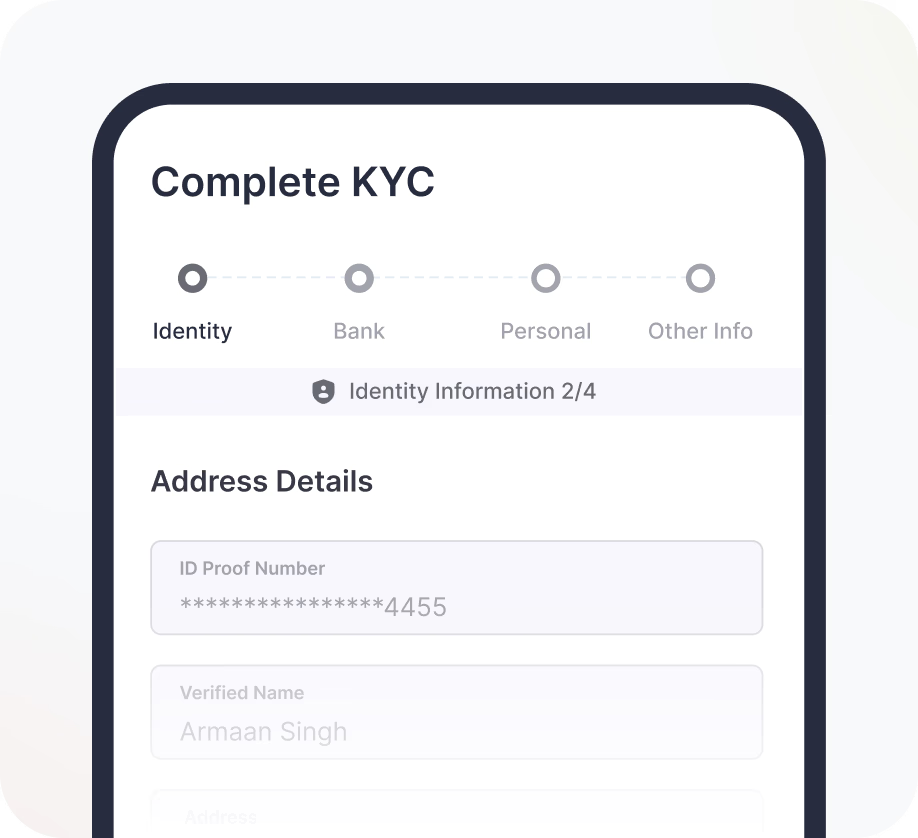

Complete KYC and Begin Your Journey

3

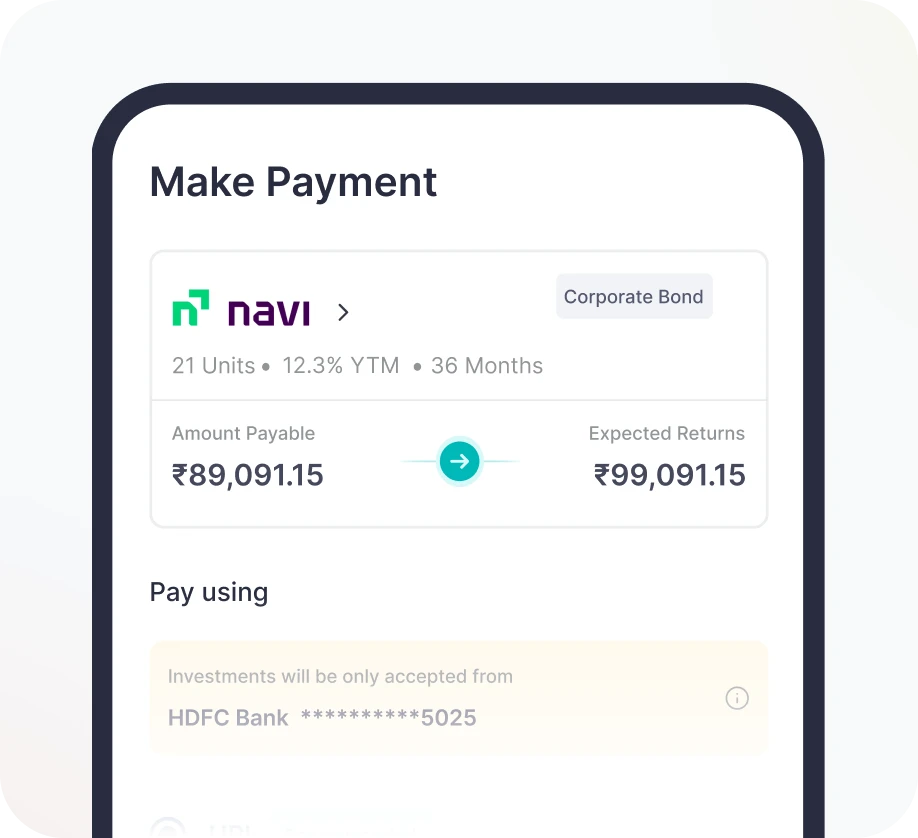

Invest & Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Conclusion

Debentures in India are credit-rated instruments that might offer a fixed income-generating avenue to investors. The wide range of debentures available in the market promotes investor choice and flexibility. Optimum portfolio diversification can be achieved by choosing the debenture that best suits the individual financial goals. GRIP has streamlined the process of debenture investment by creating an investor-friendly user interface that provides a one-stop solution to most investors' needs and questions.

Planning to start your bond investment? Login to Grip Invest today!

FAQ's on Debentures Bonds

How do debentures differ from other bonds?

How do debentures differ from other bonds?

How do debentures differ from other bonds?

What are the different types of debentures?

What are the different types of debentures?

What are the different types of debentures?

Who typically issues debentures?

Who typically issues debentures?

Who typically issues debentures?

What risks are associated with debentures?

What risks are associated with debentures?

What risks are associated with debentures?

How is the interest on debentures paid?

How is the interest on debentures paid?

How is the interest on debentures paid?

Who Should Consider Investing In Debentures ?

Who Should Consider Investing In Debentures ?

Are debentures secured or unsecured?

Are debentures secured or unsecured?

Are debentures secured or unsecured?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

more about bond

All you need to Know about High-Yield Bonds

All you need to know about Debentures

All you need to know about Debentures