Invest in High-Yield Corporate Bonds

Invest in High-Yield Corporate Bonds

Invest in high-yield corporate bonds with Grip Invest to give an edge to your portfolio and maximise returns.

Invest in high-yield corporate bonds with Grip Invest to give an edge to your portfolio and maximise returns.

Buy High-yield bonds

Why High-Yield Corporate Bonds?

Investment in high-yield corporate bonds can give an edge to an investor's portfolio and help maximise returns. These bonds have higher risks, resulting in interests reaching as high as 14%. Appropriate for individuals with high-risk endurance, the risks might be mitigated through investor prudence and diversification. Investors aiming for return maximisation can be attracted to these bonds.

Grip Invest deals

List of High-Yield Rated Bonds on Grip Invest

BOND Directory

List of High-Yield Rated Bonds

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

Load More

All you need to Know AAA Rated Bonds

High-Yield Bonds Investments

The bond market in India has witnessed a growth rate of 77% in the last 5 years.

The exponential growth of the Indian economy has caused a dynamic shift in investor temperament. Investors today don’t rely solely on traditional low-risk return-generating instruments, resulting in a rise of assets like High-Yield Bonds.

An analysed and informed investment into High-yield bonds in India can empower investors by making the best of their risk appetite. With smart investing, investors can optimise returns in this high-stakes risk-return trade-off.

What are High-yield bonds? How do they work?

Compared to A-rated bonds, investment-grade high-yield bonds are rated BBB+ and offer a higher yield, ranging from 13 to 14% Yield-to-Maturity (YTM). The high return of these bonds is the result of a comparatively higher risk associated with them.

Further, the sign of ‘+’ or ‘-’ indicates a higher or lower level of risk associated with the instrument. For example, bonds with a ‘AAA+’ or ‘AAA++’ rating will be the highest rating levels. Apart from this, some agencies also have AAA AAA rating for the highest safety. It may differ based on credit rating agencies.

Understanding this rating scale can help investors select their required level of risk in the instruments.

What causes the risk?

High-yield bonds work just like regular bonds. Their risk often arises from the nature of companies that issue the bonds.

Bonds issued by start-ups are often categorised as High-yield bonds due to their lack of financial history.

Bonds of capital-intensive companies are high-yield due to their high debt ratios.

Therefore, not all high-yield bonds belong to financially unstable companies.

Credit rating of High Yield Bonds

High-yield bonds can optimise returns if investments are made after prudent analysis. Trusted Credit Rating Agencies (CRAs) can help investors understand the credibility of these bonds.

Although the rating methodology of agencies often has subtle differences, they perform diligent research into financial statements and others to give credible information to the users.

Credit Rating

Description

AAA

Highest safety with the lowest credit risk.

AA

High safety and timely management of obligations.

A

Adequate safety levels.

BBB

Medium credit quality.

BB

Moderate quality and default risk.

B

Significant default risk.

C

High default risk.

D

Expected to default soon. Lowest safety.

Features of High Yield Bonds

High yield

The returns on high-yield bonds are significantly higher than other top-rated bond investments. The yield can reach as high as 14%.

High risk

These bonds are riskier than AA or AAA rated bonds resulting in a lower rating than them. This risk can be mitigated through optimum diversification.

Credit rating

The high-yield bonds are graded by rating agencies like CRISIL, ICRA, CARE and many more.

Past default history

The connectivity of the web can give investors a detailed history of any past defaults with a few simple searches.

Nature of companies

The companies that issue high-yield bonds can range anywhere from start-ups and capital-intensive businesses to distressed units. Due diligence is necessary to choose the “investment-grade” high-yield bonds.

Maturity

High-yield corporate bonds in India often have a shorter maturity period than other bonds.

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

Advantages of investing in High-Yield Bonds

Advantages of investing in High-Yield Bonds

Maximising returns

Returns on High-yield bonds reach as high as 14%. Their interest rate, called coupons, are higher than other bonds.

Flexibility

The maturity period of this bond is usually lower than investment-grade bonds, giving investors flexibility. They don’t need to keep funds tied up for prolonged periods.

Beat the inflation

Returns depreciate with rising inflation. High-yield bonds can allow investors to save their funds from the adverse impact of inflation.

Past default history

The connectivity of the web can give investors a detailed history of any past defaults with a few simple searches.

SEBI regulated

High-yield bonds come under the purview of SEBI, ensuring investor protection.

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

Risks and challenges associated with High-Yield Bonds

The low rating of High-yield bonds stems primarily from the following risks associated with them.

Default risk

It refers to non-payment of the amount invested in the bond and interest due. Investors can cushion against this risk by choosing “investment-grade” high-yield bonds.

Interest rate risk

It indicates falling bond value due to a rise in the market interest rates. The short-term maturity of high-yield investments can help minimise this risk.

Market volatility

Like any other market security, high-yield bonds face market fluctuations. Diversification of the portfolio can reduce the impact of volatility.

Past default history

The connectivity of the web can give investors a detailed history of any past defaults with a few simple searches.

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

Who should consider High-Yield Bonds

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

High-risk tolerance

High-yield bonds work best for investors with high-risk tolerance. Risk tolerance is determined by regular income inflow and the quantum of the investible corpus.

Income-focused

Investors who are primarily aiming to increase their returns can opt for high-yield bonds. They act as a good source of passive income generation.

Diversified portfolio

Individuals with diversified portfolios can cushion against the potential risks associated with high-yield investments. They can allocate a percentage of their investible corpus to maximise returns.

Past default history

The connectivity of the web can give investors a detailed history of any past defaults with a few simple searches.

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

How to assess credit risk of High-Yield Bonds

Investments are successful if done according to investor temperament. Investors with the below characteristics can choose high-yield bonds:

Credit ratings

Lower ratings indicate high risk and return. Investors must avoid junk bonds and choose “investment-grade” high-yield bonds.

Financial statements

Particularly the cash flow statements, interest coverage ratios and other debt ratios can give an investor a deep understanding of the issuer’s creditworthiness.

Past default history

The connectivity of the web can give investors a detailed history of any past defaults with a few simple searches.

Downgrading

CRAs can reduce the rating of a bond in light of new information. Checking for any downgrading can indicate any increased risk.

Usually, checking the credit rating gives a holistic view of the creditworthiness, but investors can get a more detailed view through the following.

more about bond

All you need to Know about High-Yield Bonds

High-Yield Bonds Investments

High-Yield Bonds Investments

High-Yield Bonds Investments

What are High-yield bonds? How do they work?

What are High-yield bonds? How do they work?

What are High-yield bonds? How do they work?

What causes the risk?

What causes the risk?

What causes the risk?

Credit rating of High Yield Bonds

Credit rating of High Yield Bonds

Credit rating of High Yield Bonds

Features of High Yield Bonds

Features of High Yield Bonds

Features of High Yield Bonds

Advantages of investing in High-Yield Bonds

Advantages of investing in High-Yield Bonds

Advantages of investing in High-Yield Bonds

Risks and challenges associated with High-Yield Bonds

Risks and challenges associated with High-Yield Bonds

Risks and challenges associated with High-Yield Bonds

Who should consider High-Yield Bonds

Who should consider High-Yield Bonds

Who should consider High-Yield Bonds

How to assess credit risk of High-Yield Bonds

How to assess credit risk of High-Yield Bonds

How to assess credit risk of High-Yield Bonds

How to Invest in High-Yield Bonds Through Grip Invest?

Grip Invest provides a range of corporate bonds for investment. Investors can follow these steps to invest in high-yield bonds through Grip Invest:

1

Sign up to Grip Invest.

Sign up to Grip Invest to browse through AAA rated bonds.

2

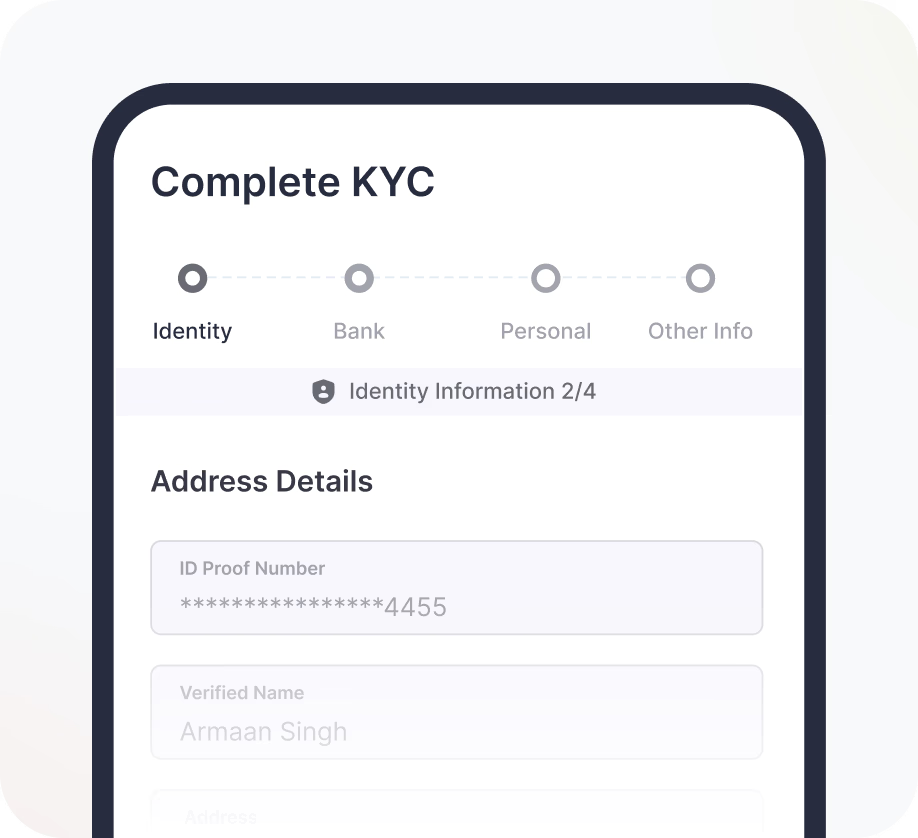

Complete KYC and Begin Your Journey

3

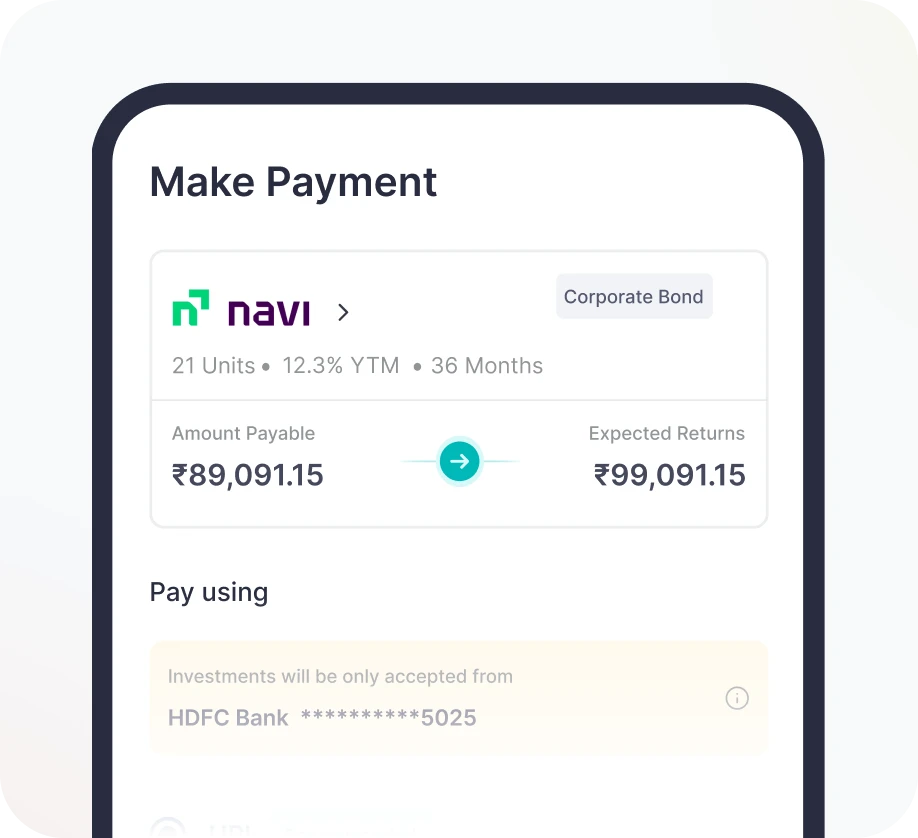

Invest & Pay Securely

Conclusion

Are High-Yield Bonds Suitable for You?

Investment in High-yield bonds is appropriate for individuals with a high-risk tolerance and sufficient investment corpus. Investors can invest in high-yield bonds in India to optimise their diversified portfolios.

Log in to GripInvest and choose from the vast array of credit-rated high-yield corporate bonds for your next investment.

GRIP SPEAKS

More about Bonds

Your Guide To Risk-Free Returns And Financial Security

8 mins read

Grip Invest Dec 10, 2021

Bonds

Understanding Bond Credit Rating

8 mins read

Grip Invest Dec 10, 2021

Bonds

What are Investment Grade Bonds

6 mins read

Grip Invest Jan 07, 2025

Bonds

Investment Grade Vs. Non-Investment Grade Bonds

6 mins read

Grip Invest Dec 10, 2021

Bonds

FAQ's on High-Yield Bonds

What is the difference between investment-grade and High-yield bonds?

Investment grade bonds are AAA or AA-rated bonds. High-yield bonds are rated below the investment grade bonds and give more returns than them. A lower rating signifies greater risk and return.

What is the difference between investment-grade and High-yield bonds?

Investment grade bonds are AAA or AA-rated bonds. High-yield bonds are rated below the investment grade bonds and give more returns than them. A lower rating signifies greater risk and return.

What is the difference between investment-grade and High-yield bonds?

Investment grade bonds are AAA or AA-rated bonds. High-yield bonds are rated below the investment grade bonds and give more returns than them. A lower rating signifies greater risk and return.

What are high-yield corporate bonds?

What are high-yield corporate bonds?

What are high-yield corporate bonds?

Are high-yield bonds a good investment?

Are high-yield bonds a good investment?

Are high-yield bonds a good investment?

Who should buy high-yield bonds in India?

Who should buy high-yield bonds in India?

Who should buy high-yield bonds in India?

How to buy High Yield Bonds?

How to buy High Yield Bonds?

How to buy High Yield Bonds?

What are the risks associated with High Yield Bonds?

What are the risks associated with High Yield Bonds?

What are the risks associated with High Yield Bonds?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

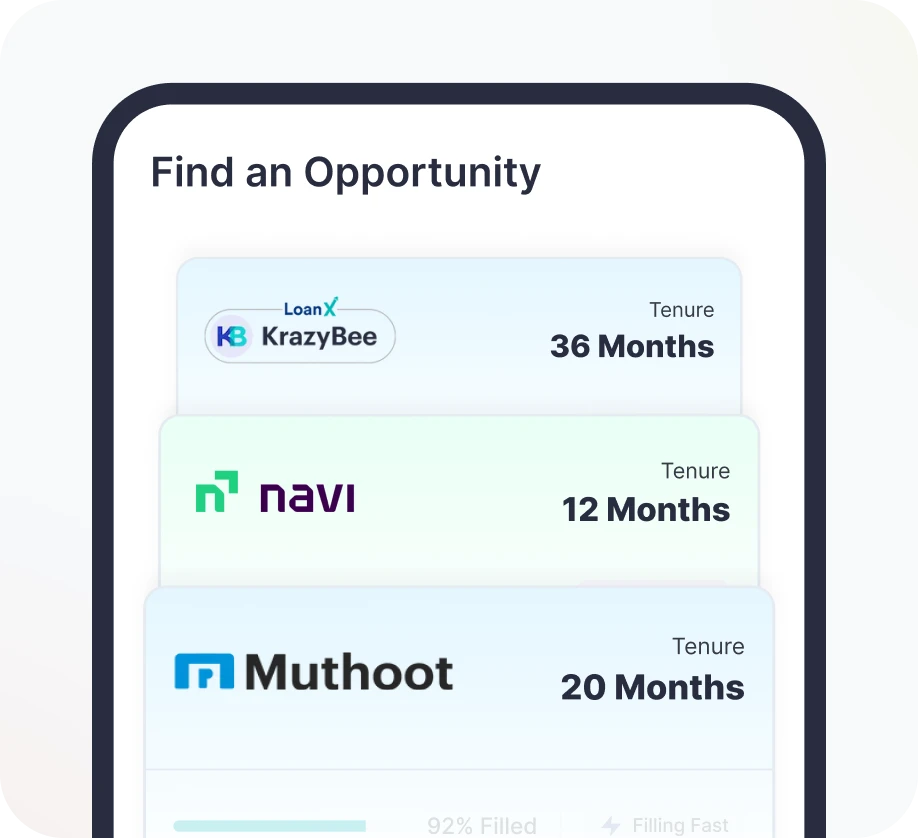

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in High-Yield Bonds Through Grip Invest?

Grip Invest provides a range of corporate bonds for investment. Investors can follow these steps to invest in high-yield bonds through Grip Invest:

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

How to Invest in High-Yield Bonds Through Grip Invest?

Grip Invest provides a range of corporate bonds for investment. Investors can follow these steps to invest in high-yield bonds through Grip Invest: