Invest in Covered Bonds

Invest in Covered Bonds

Enjoy collateral security, high credit quality, double recourse benefits and market returns with covered bonds. Browse various options now!

Enjoy collateral security, high credit quality, double recourse benefits and market returns with covered bonds. Browse various options now!

Explore covered bonds

What Are Covered Bonds?

Investment objectives vary across investors, but capital safety is often a top priority. Debt instruments align with this objective due to their nature of obligation for the issuing entity. However, there are some debt instruments which can provide double security for risk-averse investors. Covered bonds are one such instrument that is backed by a pool of assets to provide additional security.

Covered bonds share characteristics with corporate bonds and mortgage-backed securities but remain on the issuer's balance sheet, unlike securitised debt instruments (SDIs). Usually, when a bond is issued, the bondholder is the general creditor for the issuing entity. However, in the covered bonds, investors are preferential creditors and can claim the asset pool when the issuer defaults.

Grip Invest deals

List of Covered Bonds on Grip Invest

BOND Directory

List of Covered Bonds in India

Name

Rating

Remaining Tenure

Coupon

Load More

Load More

Load More

All you need to Know about Covered Bonds in India

How Do Covered Bonds Work?

Covered bonds have a specific meaning and scope due to the asset pool and particular issuing institution. Therefore, understanding its procedure becomes crucial.

Covered bonds are issued by entities like mortgage institutions and banks.

The secured mortgage loans, which are assets for these institutions, are pooled into a group to provide cover for the bonds.

This group of assets backing the bonds is known as a cover pool. The pool is managed by the issuing authority while the assets remain on its balance sheet.

The issuing authority is liable for regularly monitoring the cover pool to avoid any underperforming assets.

In case of bankruptcy, investors can get the double recourse benefit. This means they have a claim both on the issuer and on the cover pool backing their bonds.

Therefore, investors have the right to claim the assets of the issuer and the cover pool, as per the situation.

The amalgamation of market returns with security makes this bond category a potential investment option.

Types Of Covered Bonds

Based on the different characteristics of the covered bonds, they are categorised mainly by regulatory nature, cover pool and redemption.

Particulars

Description

Covered Bonds based on the regulatory nature

Legislative

These covered bonds are backed by specific legislation mentioning about claims of investors, redemption nature, maturity, and more to protect investors.

Contractual

Here, the bond is issued with a contractual agreement mentioning all the applicable regulations. During the default, investors can claim based on the conditions in the contract.

Covered Bonds based on the cover pool

Static

In such covered bonds, the assets in the cover pool stay the same. Despite any change in their performance, they remain in the pool.

Dynamic

Here, the constituents of the cover pool are closely monitored and changed based on their performance.

Covered Bonds based on redemption

Hard bullet

Bondholders get their investment amount on a fixed maturity date. If the issuer defaults on this day, investors can claim the cover pool as per the norms.

Soft bullet

Here, the maturity date of a covered bond can be shifted or postponed up to a specific tenure.

Conditional pass-through

Despite a fixed maturity date, the redemption can be delayed if specific conditions are not fulfilled. It benefits issuers with remoteness from bankruptcy or default.

Key Features Of Covered Bonds

Some of the features that stand out for covered bonds are:

Cover Pool

It can include different types of loans related to infrastructure, ships, public debt, real estate, and more.

Credit Rating

Due to high safety, the covered bonds usually have a high credit rating.

Assets

Covered bonds do not use a special purpose vehicle (SPV); instead, the cover pool remains on the issuer's balance sheet.

Bankruptcy Remoteness

It affects the security of assets if the issuer defaults. In covered bonds, it is decided through the framework or regulations of the issuing authority

Double Recourse

In the case of default, investors can claim the assets of the issuer along with the cover pool to fulfil their claim.

Benefits of Investing in Covered Bonds

The key advantages of investing in covered bonds are:

Safety And Credit Rating

These bonds are over securitised and protect the capital despite any circumstances like defaults. This also increases the credit rating for the covered bonds.

Market Returns

Being a type of corporate bond, investors can get the desired market exposure for their portfolios.

Passive Income

Based on the payout nature of a covered bond, investors can also plan a passive income source.

Cash Flow

The issuing authority is liable for regular monitoring of the assets, it helps maintain a check on the required cash flows.

Risks And Challenges Associated With Covered Bonds

Despite different benefits, investors should manage certain risks before they buy covered bonds.

Credit Risk

The issuing authority, its asset portfolio, cover pools, and historical repayment should be checked before investment.

Complexity

The mechanism and management of the covered bonds may be complicated for many investors. Therefore, one should understand the instrument thoroughly before investing.

Prepayment Risk

This arises when the loan borrower pays the loan early, and the final effect is borne by the investors. It can be managed by checking the cover pool.

Covered Bonds vs Asset-Backed Securities

Due to the nature of collateral backing, the covered bonds may be perceived as similar to asset-backed securities (ABS). However, they differ in the following ways:

Basis of Difference

Covered Bonds

Asset-Backed Securities

Special Purpose Vehicle (SPVs)

The cover pool is not transferred to SPVs and assets are present on the balance sheet of the issuing entity.

Assets are transferred to SPVs, which end their direct association with the balance sheet of the issuer.

Recourse

Investors can claim the assets of the issuer and the cover pool in case of a default.

Investors can claim the assets in SPVs in case of default.

Risk

Investors face lower risk due to regular monitoring of the cover pool and no SPV.

Investors are exposed to any performance risk associated with the assets.

Who Should Invest In Covered Bonds?

The key feature of covered bonds is their capital safety. Therefore, risk-averse investors may find this investment most suitable. Here, due to the high priority for safety, interest may be moderate or low. Therefore, conservative investors can use covered bonds to diversify their portfolios with market exposure.

How To Invest In Covered Bonds In India

Investors can explore the different covered bond investments on the official website of the RBI Retail Direct.

Moreover, to compare options and analyse the investments, investors can use reliable bond platforms like Grip Invest.

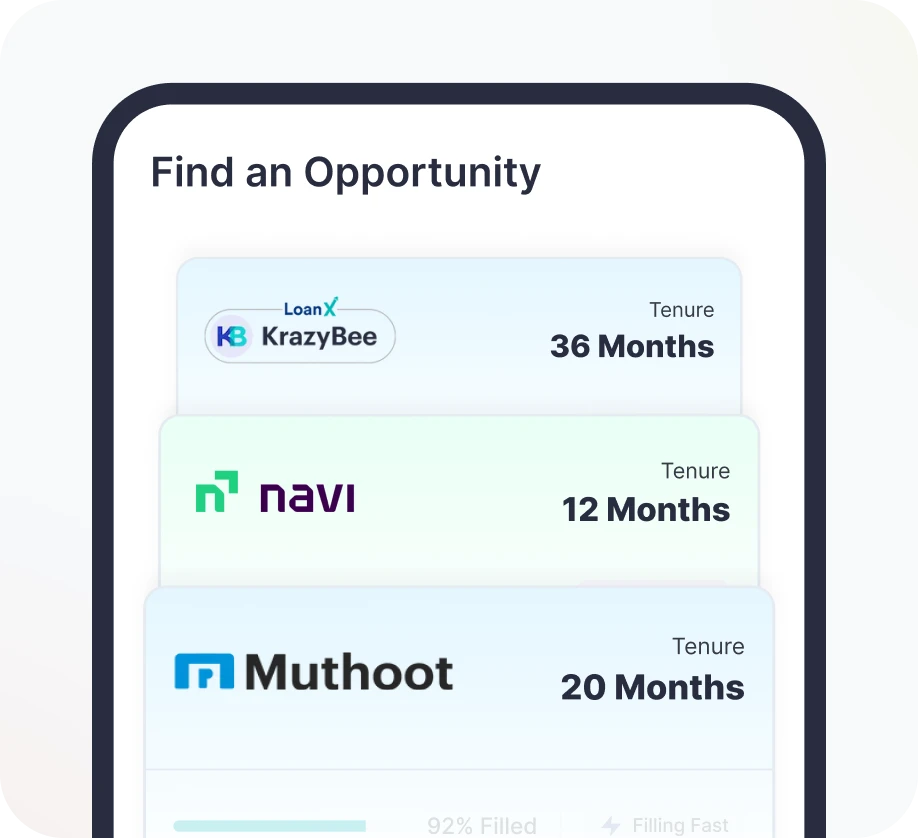

1

Sign up to Grip Invest.

Sign up to Grip Invest to browse through AAA rated bonds.

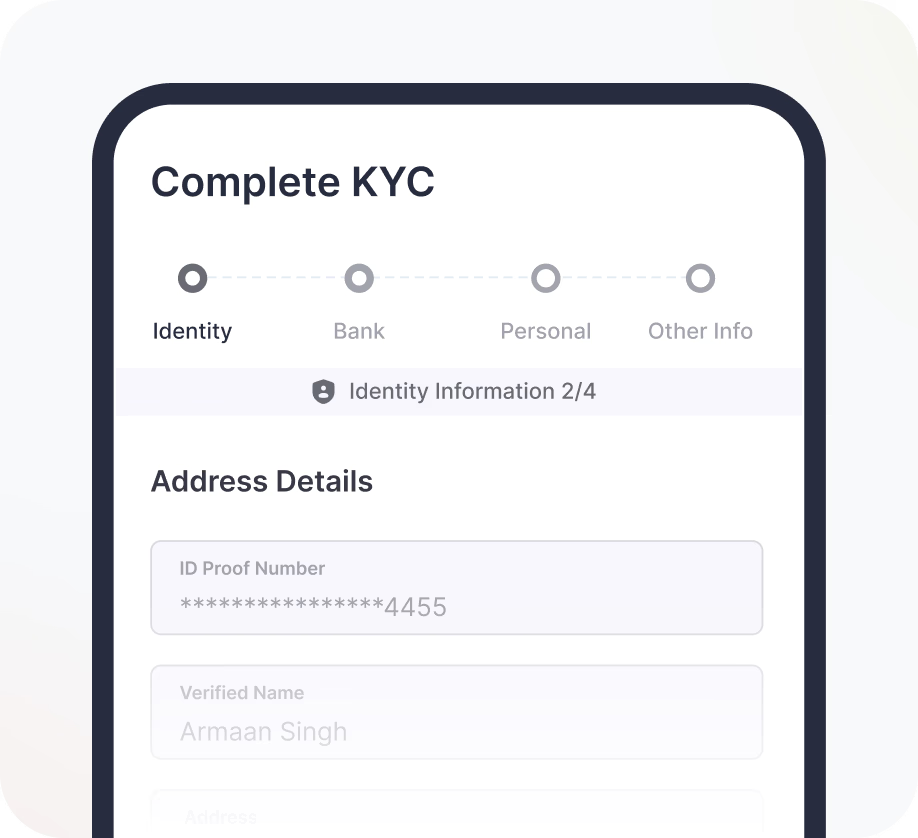

2

Complete KYC and Begin Your Journey

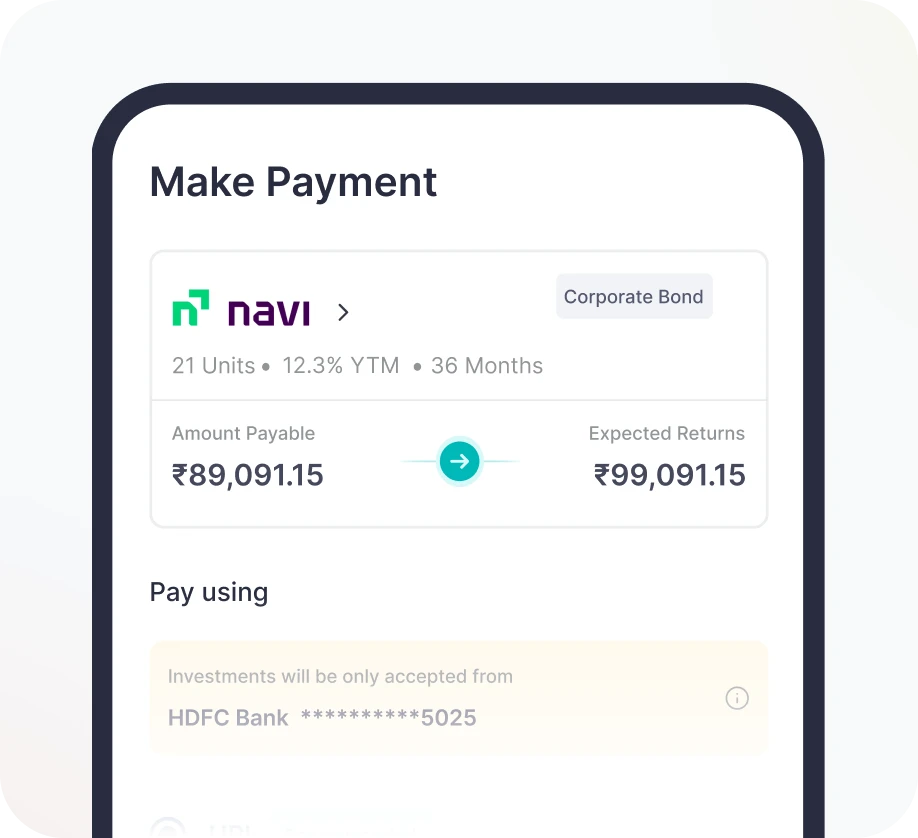

3

Invest & Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Discover Bonds Tailored to Your Needs

Complete KYC and Begin Your Journey

Invest and Pay Securely

Conclusion

Are Covered Bonds Right for Your Portfolio?

Covered bonds are debt instruments with asset-backed cover pools issued by financial institutions. This type of corporate bond can provide unique diversification to the portfolio. Risk-averse investors and people willing to explore unique assets may find covered bonds to be a suitable avenue.

Planning to invest in covered bonds? Login to Grip Invest today!

GRIP SPEAKS

More about Covered Bonds

FAQ's on Covered Bonds

What is the difference between bonds and covered bonds?

What is the difference between bonds and covered bonds?

What is the difference between bonds and covered bonds?

Why invest in covered bonds?

Why invest in covered bonds?

Why invest in covered bonds?

Who issues covered bonds in India?

Who issues covered bonds in India?

Who issues covered bonds in India?

Are covered bonds considered low-risk investments?

Are covered bonds considered low-risk investments?

Are covered bonds considered low-risk investments?

How are covered bonds regulated?

How are covered bonds regulated?

How are covered bonds regulated?

What is the typical maturity period for covered bonds?

What is the typical maturity period for covered bonds?

What is the typical maturity period for covered bonds?

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Download the Grip Invest App and stay connected 24/7

Get personalized deal recommendations

Gain insights on your portfolio performance

Receive instant updates and notifications

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

Grip Invest is a SEBI-regulated platform for high-yield, fixed-income investments like Corporate Bonds and SDIs. Our mission is to enable all Indians to invest in regulated, curated, diversified opportunities offering attractive, predictable returns.

Grip Broking Private Limited

Grip Broking Private Limited (U67120DL2023PTC410290), Member of NSE- SEBI Registration No.: INZ000312836, NSE Member Code: 90319

Registered Office: Flat No. 106, II Floor, New Asiatic Building, H Block, Connaught Place, New Delhi-110001

Corporate Office: Plot No. 3, Veritas Building, 6th Floor, Golf Course Road, Sector 53, Gurgaon-122003, Haryana

Compliance Officer: Ms. Jyotsna; Contact No: +91 93555 90389; Email id: complianceofficer@gripinvest.in

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/or default in payment. Read all the offer related document carefully.

Procedure to file a complaint on SEBI SCORES- (i) Register on SCORES portal (ii) Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID (iii) Benefits: Effective communication, Speedy redressal of the grievances

i. Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your Stock Brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Prevent Unauthorized Transactions in your demat account Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL/CDSL on the same day.

ii. There is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Issued in the Interest of Investor. Investments in securities market are subject to market risks; read all the related documents carefully before investing.

iii. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

iv. Investor awareness on fraudsters that are collecting data of customers who are already into trading on Exchanges and sending them bulk messages on the pretext of providing investment tips and luring them to invest with them in their bogus firms by promising huge profits.

v. Advisory for investors - Clients/investors to abstain them from dealing in any schemes of unauthorised collective investments/portfolio management, indicative/ guaranteed/fixed returns / payments etc.

Attention Investors:

1. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

2. Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge.

3. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. .......... Issued in the interest of Investors

SEBI: https://www.sebi.gov.in | NSDL: https://nsdl.co.in | CDSL: https://www.cdslindia.com | NSE: https://www.nseindia.com | BSE : https://www.bseindia.com | SMART ODR PORTAL: https://smartodr.in/login | SCORES 2.0: https://scores.sebi.gov.in | Sitemap

Made with love️ in India | Copyright © 2024, GripInvest

more about bond

All you need to Know about High-Yield Bonds

All you need to Know about Covered Bonds

All you need to know about Covered Bonds